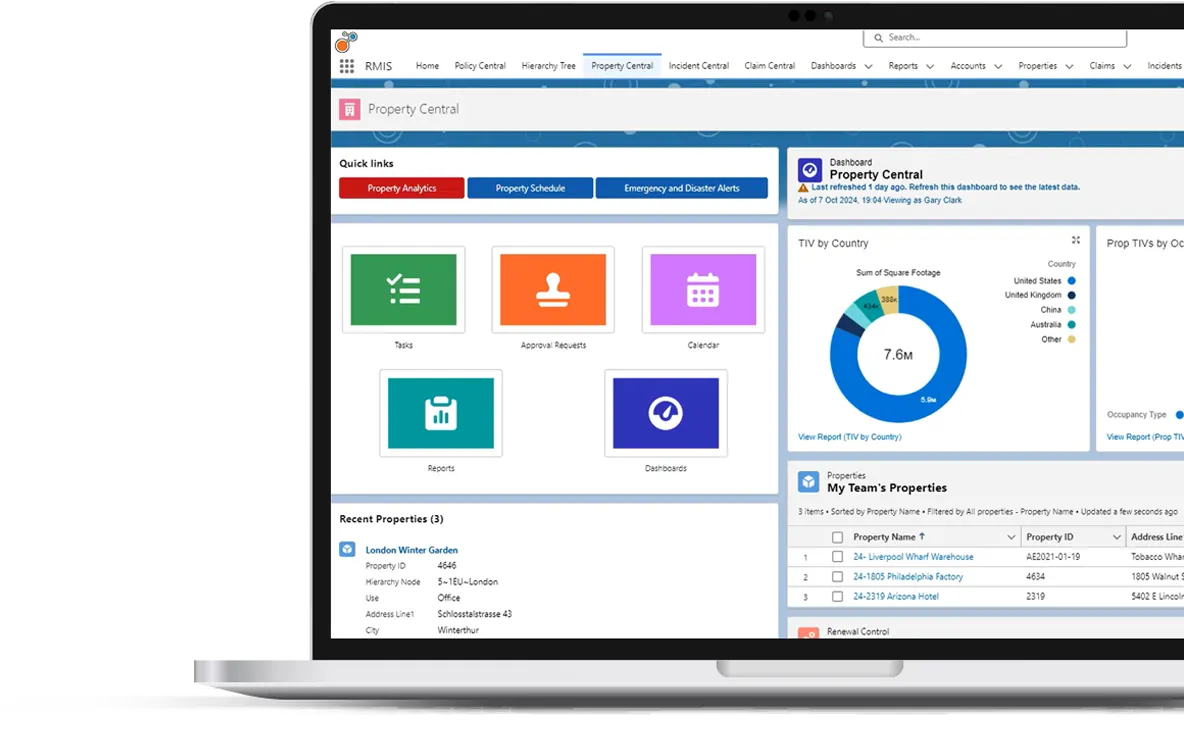

RMIS Software

Risk Management Information System

Riskonnect’s RMIS software gives you the data, analytics, and insight to turn risk into a strategic advantage.

Focus your time on where you can make a difference. Spend less time chasing down data and more time analyzing what it means.

Communicate effortlessly from the frontlines to the C-suite. Break down silos and seamlessly share always up-to-date risk data across the organization.

Make confident decisions boosted with Intelligent Risk. Generate actionable insights using Riskonnect’s AI-powered risk-decision engine.

RMIS Software

Product Highlights

Randstad

Riskonnect has allowed us to embark on actions we’ve never had clarity on before. If no action is coming out of the data, what’s the point.”

Trey Braden, Director, Risk Management, Randstad

IHG® Hotels & Resorts

Riskonnect is helping us in terms of achieving financial accuracy for payments for insurers, which is great. We have full visibility of what’s going on in terms of claims management from start to end.”

Marcela Siera, Insurance Systems Manager, IHG® Hotels & Resorts

Reimagined Parking

Anybody in the claims industry knows that the longer a claim is open, the more costly it is. With Riskonnect we now have a more efficient claims intake process and quicker triaging, helping to reduce claims duration and expenses.”

Jeff Hauf, Senior Director of Claims, Reimagined Parking

Reduce Costs

and Increase Profitability

Feeling the pressure to correctly anticipate what’s ahead – in less time with fewer resources? Riskonnect’s RMIS software seamlessly integrates people, systems, and data to help you make more informed decisions about risk. Your costs go down and profitability goes up.

- Consolidate real-time risk data from multiple internal and external sources to identify trends, emerging risks, and opportunities.

- Understand the relationships between critical risks and the impact on the organization.

- Seamlessly integrate data from carriers, TPAs, third-party vendors, and internal departments into one source of truth.

- Gain strategic insights to optimize your insurance program.

- Identify cost-savings opportunities that previously may have gone unnoticed.

Find Instant Relief

from Daily Pain Points

If you’re stuck tracking down information with endless back-and-forth emails, when are you supposed to figure out what it all means? Riskonnect’s RMIS software streamlines and automates routine processes so you can say goodbye to boring repetitive tasks and hello to delivering human-worthy insights from data you trust.

- Save time and money by streamlining and automating processes.

- Capture data consistently and thoroughly with standard templates, intuitive forms, and auto-filled fields.

- Minimize human error by guiding users through the data-collection process.

- Eliminate duplicate data entry by automatically uploading and extracting information from ACORD forms.

- Send alerts, reminders, and progress reports automatically.

- Communicate seamlessly using SMS text, WhatsApp, and other channels.

Make Smarter Decisions

Faster

Can you deliver the level of risk insight demanded by the C-suite? Riskonnect’s RMIS software gives you unprecedented insight into your risks and their relationships so you can quickly and confidently decide what to do.

- Improve communication about risks across departments and with the C-suite.

- Create easy-to-interpret reports that communicate a clear picture of your risks.

- Instantly summarize complex, lengthy claims documents.

- Generate actionable insights using embedded AI-powered predictive analytics models.

Get Started with These Helpful Resources

Industry Recognition for Riskonnect