Riskonnect for the Financial Services Industry

Riskonnect software integrates risk data, analytics, and insight to give you a leg up on the competition.

Financial services organizations are under constant pressure to manage constantly evolving risks, comply with ever-expanding regulations, protect customers, and achieve profitable growth. At the same time, regulators are closely scrutinizing risk and compliance systems and levying big fines on those deemed too disconnected to be effective.

Do you have the processes, people, and technology in place to stay on course?

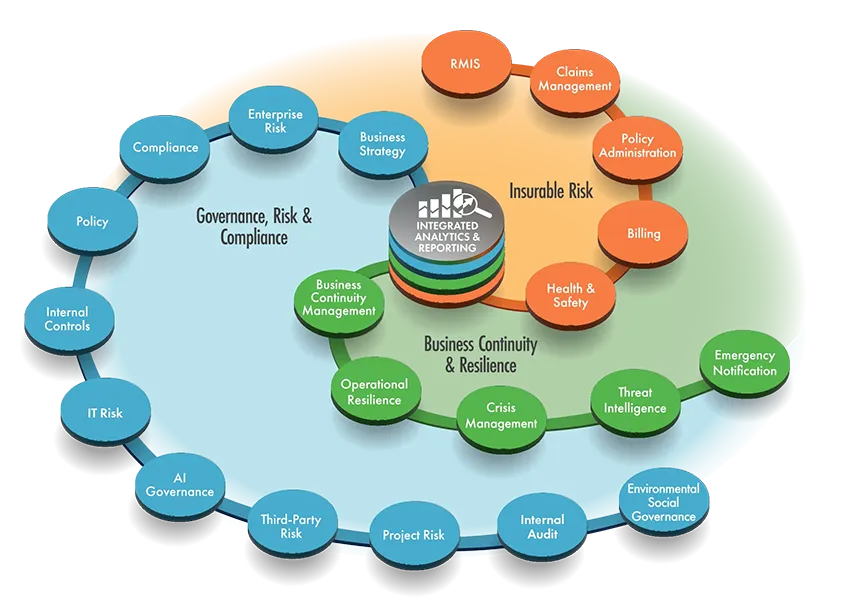

An Integrated Approach to Managing Risk and Compliance

Riskonnect connects the dots between all types of risk – insurable and noninsurable, strategic and operational – so you understand what you’re facing, how everything interrelates, and the cumulative impact on the organization.

The software breaks down silos, automates manual processes, and improves response time. For the first time, you can see the full impact of a single risk event on the entire business. And all of that intelligence is right at your fingertips.

Find answers – fast.

Everything you need to identify, manage, and mitigate risk is all in one, easily accessible place.

Get more done.

Routine processes are streamlined and automated so you can spend your time where it matters most.

Make better decisions.

Riskonnect gives you the intelligence to identify and respond to evolving risk, stay compliant across the board, and make informed decisions that will add value to the business.