RMIS: The Definitive Guide

What is a RMIS?

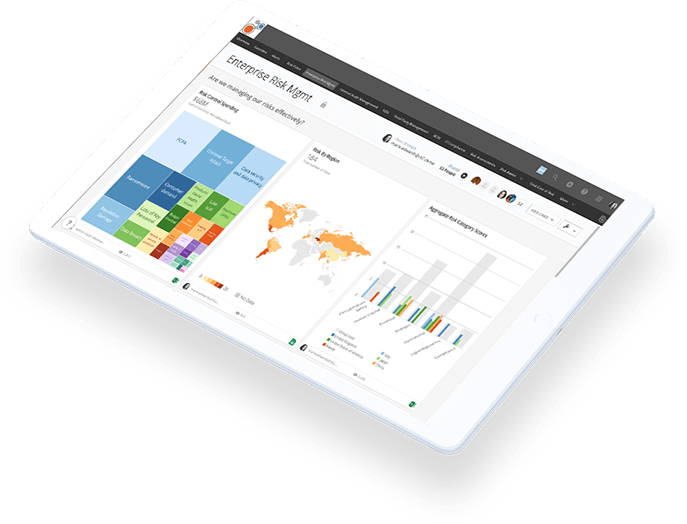

A Risk Management Information System – RMIS – is a software platform for collecting, managing, analyzing, and reporting risk, claims, and safety information.

A RMIS brings all of your insured risk data together into one place to give you a clear view of your risks, the relationships, and the impact on the organization. A RMIS saves time and improves accuracy by automating tasks and streamlining workflows. It reduces risk exposure, the stress on risk management – and total cost of risk.

With a RMIS, risk teams can stop managing spreadsheets, documents, and emails and start managing risk at a strategic level.

– Bob Bowman, Director, Risk Management, The Wendy’s Company

Do You Need a RMIS?

A RMIS brings all of your risk data together into one platform for unprecedented insight into your risks, the interrelationships, and the impact on the organization. But all that functionality, of course, comes with a price tag. The question is, will your return be worth that investment?

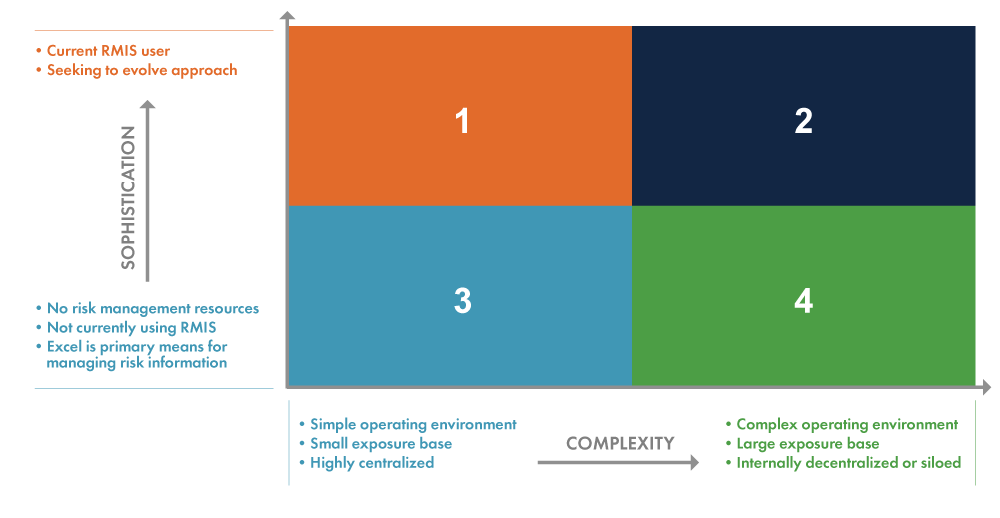

The answer depends on the complexity of your risks and how sophisticated your needs are. Here are 11 questions to help you decide whether or not you need a RMIS.

78.5% of organizations recently surveyed report using a RMIS to manage risk.

- Do you work with only one insurance carrier or TPA (past and present)?

- Do you have low frequency and severity of claims?

- Are you able to easily report to your executive management and/or board?

- Is your risk, safety, and claims data easily accessible wherever and whenever it’s needed?

- Is it easy to collect and analyze the information you need for insurance renewals?

- Are you confident in the integrity of your data?

- Are you pleased with the level of insight you are getting from your data analysis?

- Are you sure that there are no duplications or gaps in coverage?

- Can you view the current status of a claim?

- Are your reports easy to run – and are they sophisticated enough for your purposes?

- Can you easily answer questions about premiums, coverage, and claims history?

If the majority of your answers are “yes” – Your current system for managing risk is doing its job. A periodic review of the status will make sure you stay on track as your needs grow and change. (Quadrant 3)

If the majority of your answers are “no” – Your current system has become more of a hindrance than a help, and it’s limiting your ability to manage risk effectively. A RMIS could provide the foundation you need to manage risk at a more strategic level. (Quadrants 1, 2, and 4)

Popular RMIS Uses

Having the right tool makes any job easier – and managing risk is no exception. Too often, though, organizations make do with spreadsheets or an outdated legacy system simply because that’s the way it’s always been done.

New RMIS tools can make all aspects of managing risk easier, faster, and more effective.

Here are some of the most popular ways to use a RMIS:

(scroll Left <- and -> Right to view data)

| RMIS TOOL | WHAT | WHY |

|---|---|---|

| Certificate Management | Streamlines management and compliance tracking for incoming Certificates of Insurance to reduce exposure from contractors, tenants, suppliers, and other business partners. | Manually keeping track of COIs that are about to expire or fall out of compliance is a challenging, time-consuming process – and the more partners you have, the more likely it is for something to fall through the cracks. |

| Claims Administration | Provides full support from first notice to adjudication, payment, and subrogation for organizations that manage their own claims or manage claims on behalf of others. | The longer a claim lingers, the more expensive it is. Monitoring claim information in spreadsheets, documents, and emails is time-consuming and error-prone – and it’s difficult to gauge the full impact on the organization. |

| Claims Regulatory Compliance | Proactively monitors current and potential regulation, manages relationships with external entities, and executes documentation to ensure regulatory compliance. | Successfully navigating the complex rules and regulations around claims is a big job with steep consequences for noncompliance. |

| Cost Allocations | Accurately allocates premiums and fees based on your actual experience and methodology. | Holding managers accountable for their own losses is a powerful motivator to make necessary changes. Yet manually allocating shared costs is time consuming and often fraught with inaccuracies – which undermines credibility. |

| Exposure Management | Automates ongoing values collection, tracks submitted values in real time, and shows important changes from year to year. | Collecting, entering, formatting, and consolidating loss exposure information via email, documents, or phone calls is incredibly inefficient and error prone – and it has to be repeated for every renewal. |

| Incident Management | Captures data right at the source to quickly and accurately get information to those who can investigate, evaluate, and take action. | Even one safety incident can be devastating to finances, reputation, and lives – yet incidents don’t always get reported if the process is too cumbersome. And if can be difficult to make sense of information if disparate systems are used. |

| Insurance Management | Tracks and manages all of your insurance policies and features, including premiums, layers, limits, deductibles, carriers, and more. | Answering even simple questions about coverage can be difficult and time consuming if the information is buried in paper files or stored with a broker. |

| Root Cause Analysis | Quickly identifies underlying issues so safety measures can be taken in time to prevent future risk. | Costly incidents will keep happening until you stop treating symptoms and cure the real cause of the problem. |

| Reporting & Analytics | Combines powerful analytics with intuitive and flexible report design tools to help you make better decisions around your risk data. | Risk data is just numbers unless you have real-time reports and meaningful graphics to reveal the story behind the data points. |

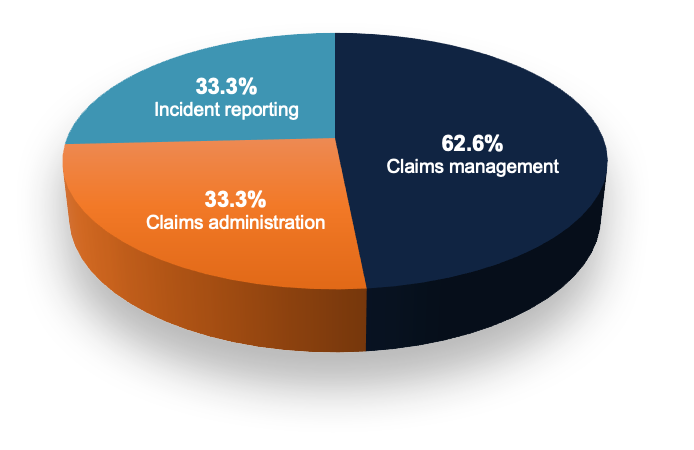

According to Business Insurance, the top three RMIS functionalities are:

Risk Management Pain  RMIS Relief

RMIS Relief

A RMIS can bring instant relief to long-standing risk management pain points.

| PAIN | RELIEF | |

|---|---|---|

| Time pressure. Manually collecting, consolidating, formatting, and analyzing data in preparation for a renewal can tie up manpower for weeks, or even months. And handling claims is just as labor intensive. |  |

A RMIS automates data collection and workflow, so you can spend less time on routine tasks and more time on strategic actions that add long-term value. |

| Disparate systems. Systems that can’t talk to each other require a lot of manual labor to bring the data together. |  |

A RMIS is designed to seamlessly handle vast amounts of data from numerous insurers/TPAs in multiple currencies. |

| Data quality. Finding and correcting an error in a giant spreadsheet is like finding a needle in a haystack. Even small errors that go undetected can wreak havoc on the integrity of a database – which can spell disaster if that information is used to make critical business decisions. |  |

A RMIS validates data as it’s entered. Any incorrect or missing information is flagged so it can be addressed immediately. Data is consolidated, formatted, and immediately ready to go into reports. |

| Limited visibility. Storing risk, safety, and claims data in numerous locations makes it almost impossible to visualize the relationships between critical risks and the cumulative impact on the organization. |  |

A RMIS brings all information together into one platform, so you can more easily identify and respond to emerging risks and trends that previously might have gone unnoticed. |

| System accessibility. Critical details can get lost or forgotten if, say, you have to go all the way back to the office to fill out an incident report. |  |

A RMIS can record events anytime, anywhere – even in the field. And the intuitive, auto-filled forms make sure that the information is captured completely and accurately. |

| Reporting. Manually extracting information from numerous sources and creating meaningful reports is no easy task. And you have to start from scratch every time the numbers change or someone wants a different report. |  |

One click is all it takes for a RMIS to turn incredibly complex data into sophisticated graphics that are understandable and actionable. |

| Segmented information. Tracking data in multiple systems is not only time consuming, but it causes problems with workflow, data consistency, and visibility. And it’s expensive. |  |

A RMIS consolidates all data into a single, up-to-the-minute source that provides a clear view to identify trends, as well as underlying issues. |

| Regulatory compliance. Ever-increasing compliance demands, combined with greater scrutiny by regulators, are turning up the pressure to produce more reports, with greater accuracy, in less time. |  |

The easy-to-use regulatory compliance workflow and reporting features of a RMIS can accommodate frequently changing regulatory and legislative requirements. |

| Security threats. If the wrong person gains access to the system or makes changes to the data, you could be in serious trouble – especially if the information is sensitive. |  |

Access to a RMIS is strictly limited to authorized users, and every change and update is documented. Your data also is stored and protected in a secure, cloud-based platform with a robust disaster-recovery infrastructure. |

PAIN

Time pressure. Manually collecting, consolidating, formatting, and analyzing data in preparation for a renewal can tie up manpower for weeks, or even months. And handling claims is just as labor intensive.

RELIEF

A RMIS automates data collection and workflow, so you can spend less time on routine tasks and more time on strategic actions that add long-term value.

PAIN

Disparate systems. Systems that can’t talk to each other require a lot of manual labor to bring the data together.

RELIEF

A RMIS is designed to seamlessly handle vast amounts of data from numerous insurers/TPAs in multiple currencies.

PAIN

Data quality. Finding and correcting an error in a giant spreadsheet is like finding a needle in a haystack. Even small errors that go undetected can wreak havoc on the integrity of a database – which can spell disaster if that information is used to make critical business decisions.

RELIEF

A RMIS validates data as it’s entered. Any incorrect or missing information is flagged so it can be addressed immediately. Data is consolidated, formatted, and immediately ready to go into reports.

PAIN

Limited visibility. Storing risk, safety, and claims data in numerous locations makes it almost impossible to visualize the relationships between critical risks and the cumulative impact on the organization.

RELIEF

A RMIS brings all information together into one platform, so you can more easily identify and respond to emerging risks and trends that previously might have gone unnoticed.

PAIN

System accessibility. Critical details can get lost or forgotten if, say, you have to go all the way back to the office to fill out an incident report.

RELIEF

A RMIS can record events anytime, anywhere – even in the field. And the intuitive, auto-filled forms make sure that the information is captured completely and accurately.

PAIN

Reporting. Manually extracting information from numerous sources and creating meaningful reports is no easy task. And you have to start from scratch every time the numbers change or someone wants a different report.

RELIEF

One click is all it takes for a RMIS to turn incredibly complex data into sophisticated graphics that are understandable and actionable.

PAIN

Segmented information. Tracking data in multiple systems is not only time consuming, but it causes problems with workflow, data consistency, and visibility. And it’s expensive.

RELIEF

A RMIS consolidates all data into a single, up-to-the-minute source that provides a clear view to identify trends, as well as underlying issues.

PAIN

Regulatory compliance. Ever-increasing compliance demands, combined with greater scrutiny by regulators, are turning up the pressure to produce more reports, with greater accuracy, in less time.

RELIEF

The easy-to-use regulatory compliance workflow and reporting features of a RMIS can accommodate frequently changing regulatory and legislative requirements.

PAIN

Security threats. If the wrong person gains access to the system or makes changes to the data, you could be in serious trouble – especially if the information is sensitive.

RELIEF

Access to a RMIS is strictly limited to authorized users, and every change and update is documented. Your data also is stored and protected in a secure, cloud-based platform with a robust disaster-recovery infrastructure.

Separating RMIS Myths from the Truth

Did you hear the one about how a RMIS is only for claims? Or that a next-generation system is too expensive? There are all sorts of unsettling rumors about the cost and limitations of a RMIS. Here is some guidance to sort out myth from truth.

Myth #1: A RMIS is only for claims.

Truth: A RMIS does make managing claims easy, fast, and accurate. Users have one centralized source to track claim status, validate data, and view payment history. You can even compare outcomes of similar claims and analyze the cause of a loss.

But managing claims is just the beginning. A RMIS seamlessly integrates all risk, claims, and safety information into a single, comprehensive, up-to-the-minute workflow continuum. It gives you the visibility to effectively manage risks across the organization. It also can reveal gaps or duplications in coverage and appropriately allocate premiums.

The real power of a RMIS, though, is when the system is leveraged to identify and respond to emerging risks and trends that might otherwise go unnoticed. The centralized view, accessible platform, and enhanced reporting of a RMIS also facilitate communication and collaboration across the organization.

Myth #2: RMIS users must be IT experts.

Truth: The current generation of RMIS software is easy to use with consumer-like features that are intuitive, integrated, and reliable.

Dashboards combine visually appealing graphics with powerful analytics to deliver the information you need when you need it. Reports are available at the touch of a button – no reformatting or cutting and pasting required. And a cloud-based system is accessible by anyone, at any time, from anywhere.

As with any new technology, however, upfront training is necessary to get the most value from your RMIS investment. Yes, there is a learning curve. But the value gained by expanding your risk understanding far outweighs the cost of sticking with your current routine.

Myth #3: A RMIS does the same job as a spreadsheet.

Truth: Comparing a RMIS to a spreadsheet is like comparing your latest smart phone to a flip phone from the ‘90s. The similarities between the two ends when you want to do anything more than the basics.

Spreadsheets can be an effective tool for managing risk at companies with limited numbers of locations, employees, assets, and carriers. But this tool has a hard time keeping up with the amount of data needed to effectively manage a growing portfolio of risk. You might end up making critical business decisions based on outdated or error-riddled data.

Spreadsheets are particularly vulnerable to:

-

- Data errors. Spreadsheets rely mostly on manual labor to collect, verify, format, consolidate, and input information. Not only is this process extraordinarily time consuming, every keystroke or cut-and-paste action increases the risk of human error.

- Security threats. Restrictions on who has access are notoriously difficult to impose on spreadsheets. As a result, information can easily fall into the wrong hands. If the spreadsheet includes sensitive information, the company could be in serious trouble.

- Disaster-recovery problems. What happens if a laptop is lost or stolen? Your data might disappear along with the laptop since spreadsheets aren’t always automatically backed up. If true catastrophe strikes, you could lose everything.

A RMIS minimizes data-entry mistakes by guiding users through a streamlined collection process. Changes and updates can be made instantly, in one place, at one time. Everything is documented so you always know who made what change and why.

Access to a RMIS is available on any device from anywhere – as long as the user is authorized. And a RMIS stores and protects your data in a secure, cloud-based system that can be verified by independent third parties.

Myth #4: One RMIS is the same as the next.

Truth: All RMIS platforms are not created equal. Organizations can choose between two main RMIS options: bundled and unbundled.

A bundled RMIS is offered by insurers, brokers, and third-party administrators. The cost of a bundled RMIS is often included in the total charged by the provider. However, the system only works with data from that provider.

If you have multiple carriers or TPAs, you could end up with numerous systems – none of which can communicate with each other. To get a comprehensive view of your risks, you would need to transform the data into a common format, consolidate it into a central location, and repeat the process each time the provider issues an update. Bringing in data from another source, such as finance or legal, will likely require a custom interface or manual input.

About 15% of organizations said their RMIS is bundled with other insurance products and services.

An unbundled RMIS is offered by an independent vendor. This type of system consolidates risk, safety, and claims data from all internal and external sources to give you a complete, integrated view of your entire risk portfolio.

While the fees could appear higher than a bundled system, an unbundled RMIS offers more sophisticated features and capabilities for analysis and reporting. It also can be customized to work with your existing systems. Integrating with HR, for instance, can add important information about employees directly into your analysis and reports. The result is you have complete insight to make critical risk and safety decisions.

The right risk management system for you really comes down to the number and complexity of your risks – and what you need to effectively manage those risks. Spreadsheets, for instance, can work well for a small number of fairly straightforward risks. A bundled RMIS can work well for companies that deal primarily with one carrier or TPA.

But if you’re trying to identify critical risks across numerous functions, business lines, and locations – and understand the evolving relationship between all these risks – you need the power of an unbundled RMIS.

This is the RMIS that can help you turn vast amounts of risk management data into clear opportunities to mitigate losses and lower overall costs, which will have a positive impact on the bottom line for years to come.

Myth #5: A RMIS is too expensive.

Truth: Buying a RMIS is a significant investment – but it ultimately pays for itself. Here’s how:

1. Increases productivity. How much time are you currently spending to collect, format, and consolidate data – then turn this information into meaningful, actionable reports? RMIS software does all this automatically, which frees up your time to actually analyze the data and respond appropriately.

2. Replaces other technology. No matter what system you’re using, you’re already spending money on some kind of technology to manage risk, safety, and claims data. The total cost of maintaining these separate systems and spreadsheets might surprise you. This is all money that can be redirected toward a RMIS.

3. Improves accuracy. The centralized view from a RMIS helps you better understand the relationships between critical risks and the cumulative impact on the organization. This information can help you make smarter, faster decisions to mitigate losses – and ultimately lower premiums.

The fact is no risk management technology is free. If the upfront cost of a RMIS seems steep, imagine trying to justify a loss caused by an undetected spreadsheet error. The true cost of any solution has to be measured in terms of the total operational cost to the organization over the long term.

– Trey Braden, Director of Risk Management, Randstad

How to Buy a RMIS

Technology, service, and features are important considerations when buying a RMIS – but those are just the start. Understanding your needs, knowing what your stakeholders demand, and selecting the right software partner is just as important.

Get your copy of the Redhand Advisors RMIS Report for a full-spectrum analysis of RMIS functionalities and top providers.

Here are ten tips for buying a RMIS to make sure you get the right solution – and the right partner:

1. Take an inventory of your current problems.

What are your pain points? What issues are you having with your current technology? Applying new technology to a broken process will not fix it. Instead, identify any breakdowns or bottlenecks upfront, and establish clear objectives that you want to accomplish with a RMIS.

2. Assemble your RMIS team.

A RMIS touches many functional areas, so it’s important to include all stakeholders in the buying process to make sure their voices are heard. Bringing diverse viewpoints together from the start ensures that critical issues are addressed early, which can help eliminate costly delays down the road.

Those who feel listened to throughout the RMIS buying journey also are more likely to be vocal supporters of the new technology during implementation and beyond.

3. Understand how the RMIS will function with your existing tech.

Inefficient workflows, outdated processes, lack of executive buy-in, and resistance to change all can negatively impact the effectiveness of your RMIS. Do your homework about the features and capabilities of the RMIS technology under consideration – and compare that to your current systems and requirements.

Keep in mind that just because something has always been done a certain way does not mean it’s the best way. Examine your workflows in detail to see if there is a more efficient way to get the job done.

Risk Management Information Systems should increase productivity by eliminating burdensome, boring, and inefficient manual tasks. And that time saved can be redirected to higher-value tasks, which will boost the effectiveness of your risk management efforts.

4. Give the RMIS a test drive.

Take time to request a demo or trial and see for yourself how accurate the vendor’s claims are.

How easy and intuitive is the user experience? Are all of the features you need accessible from a tablet, phone, and laptop? Are the reports and analytics sophisticated enough for your requirements? And how easy is it to build the reports you need?

Find out how well the RMIS interfaces with HR, payroll, legal, and other internal and external systems. And see if it seamlessly integrates with areas outside traditional RMIS boundaries of insurable risk, including enterprise risk management, third-party risk management, compliance, internal audit, and more.

5. Make time for implementation.

A RMIS is a large and complex system with multiple interfaces. Like any enterprise-wide software implementation, a RMIS implementation doesn’t happen with the flip of a switch. Replacing a decades-old system in a matter of weeks is unrealistic and will likely lead to disappointing results.

Allocate ample time to analyze, design, plan, test, and execute the software – and build in extra time for any unknowns that are unearthed during the process. Break the implementation process down into manageable phases, and keep clear lines of communication open between all parties.

Don’t rush. And don’t skimp on user-training time.

6. Know how your data will be stored and protected.

Is the RMIS cloud based? What controls are in place to prevent unauthorized access? Has the security infrastructure been independently certified?

Where is your data housed? And how are those data centers protected? What about in the event of a disaster?

7. Work with people you like and trust.

The features and functionality of a RMIS are important, but people make the real difference. In truth, your top RMIS candidates might offer fairly comparable features and functionality. In that case, it comes down to people.

Is the RMIS provider committed to building a partnership with you? Are you comfortable with everyone you’ll be working with – and will they be able to resolve issues? Are team members eager to learn about your business, are they creative problem solvers, and do they listen?

8. Demand great service.

Find out what type of support is offered – phone, online portal, email, etc. – and the guaranteed response time.

Can you access one-on-one customer care for more complex issues, as well as a traditional help desk for more routine queries?

And service should extend well beyond implementation. Does the RMIS provider have a team dedicated to your long-term success?

9. Know what you’re buying.

Have a clear understanding of what features, services, and support are covered in your RMIS contract and what it might cost if your needs change. You want a system that can easily scale and adapt as your business grows without any costly or disruptive reconfigurations.

10. And know whom you’re buying your RMIS from.

Always make sure the RMIS provider has demonstrated expertise in technology, risk, and insurance – and the longevity and resources to deliver on its promises over the long haul.

A RMIS is a significant investment that goes much deeper than technology. The care, respect, and genuine interest you experience by each vendor in the buying process is a good indication of what’s to come.

Do your due diligence. With the right RMIS partner, your new RMIS will make your job easier, your team more successful, and your company stronger.

Ready to draft an RFP for a RMIS? Start with this list of the most critical RMIS-related questions. This downloadable spreadsheet can be easily modified to suit your own needs.

The right RMIS will certainly make a risk manager’s job easier and the team stronger. It also can improve communication between departments and senior management and increase the visibility of risk management across the organization.

The challenge is to convince others of the value a RMIS can provide. The most compelling evidence is the direct cost savings you get from improved safety, lower claims, and more efficient processes. Equally important – if harder to quantify – are the strategic advantages that come from maximizing scarce resources and making smarter, faster decisions about risk.

If you are looking for help with managing an expanding risk portfolio, a RMIS could be well worth the investment – and one that could pay lasting, positive dividends to the entire organization.

Learn about Riskonnect’s RMIS solution

– or schedule your demo.