Corporate Compliance: The Definitive Guide

Corporate compliance has long been considered a check-the-box function, known primarily for enforcing rules and imposing mandatory training.

Today’s pace and scope of regulatory change has turned that way of thinking upside down. Virtually every organization in every industry is facing an ever-growing and ever-changing number of regulations with which they must comply. At last count, more than 61,000 regulatory alerts from 1,374 regulatory bodies worldwide were sent out in a single year. That’s more than 234 updates per day.

How can you possibly keep up?

Organizations without repeatable, sustainable processes to manage compliance are in clear danger of failing. And if outdated technology or processes are deeply entrenched, you might not even realize how dire the situation has become.

Organizations without repeatable, sustainable processes to manage compliance are in clear danger of failing. And if outdated technology or processes are deeply entrenched, you might not even realize how dire the situation has become.

Simply going through the motions by checking boxes is not enough anymore. One compliance misstep can result in fines steep enough to cripple the organization’s future. Organizations unable to effectively manage compliance also open the door to reputational damage that can cut much wider and deeper than any monetary hit.

C-suites and boards are responding by demanding more from the compliance function. They want hard evidence that their corporate compliance risks are being effectively addressed and managed. Can you provide that proof – or are you operating primarily on gut instinct?

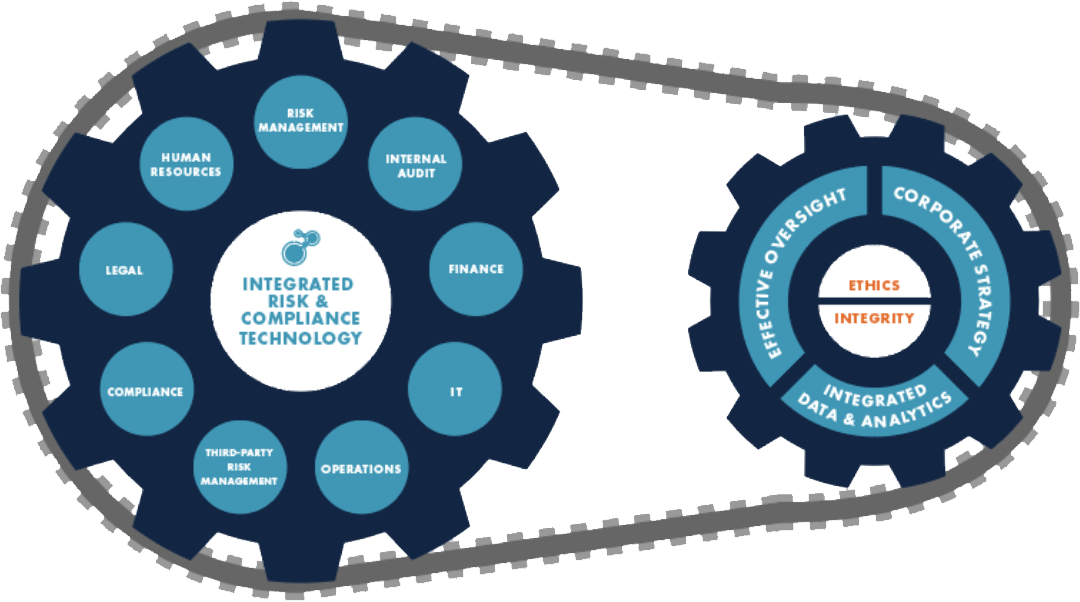

New-generation technology aggregates all corporate and legal policies, procedures, and requirements from across the organization into one centralized location for clear visibility into your compliance risk. You’ll save time and money by eliminating redundancies and identifying gaps that could leave you vulnerable. Technology also can prioritize actions and minimize risk by facilitating collaboration across the organization and integrating compliance into everyday decision-making.

Read on for guidance on transforming compliance from a check-the-box function to a well-oiled machine that seamlessly integrates people, processes, and technology with data-driven visibility to champion the organization’s future.

What Is Corporate Compliance?

Corporate compliance is responsible for making sure an organization follows the laws, rules, and regulations that apply to the business. The function is also responsible for ensuring employees and other stakeholders adhere to internal standards, policies, and procedures.

The Five Biggest Challenges to Effective Compliance Management

Compliance is complicated and expensive to manage – often made more so by the very tools and processes intended to get the job done. Otherwise capable compliance teams struggle with clunky, outgrown technology and inefficient processes. Identifying your biggest challenges is the first step toward overcoming them. What’s standing in your way?

Compliance processes are often created in response to a specific event – a new regulation, litigation, criminal investigation, and so forth – with little thought to how it all works together. When responsibilities are walled off this way, few people have the means, motivation, or opportunity to share information across functional lines.

When compliance responsibilities are confined in silos, chances are that the technology used to carry out those responsibilities is just as disconnected. That makes it very difficult to efficiently manage compliance across multiple business lines, functions, or locations. And with no easy way to exchange data, multiple people end up chasing down the same information.

Managing compliance via spreadsheets, shared files, and documents probably made sense at one time. But these tools were simply not designed to keep up with a sea of constantly changing regulations. It can take hours upon hours to manually update every spreadsheet in every location to accommodate a single regulatory change. Multiply that by the hundreds of regulatory changes that happen in real life, and you have a problem. Every piece of data that must be rekeyed or copied and pasted also opens the door to more human errors.

Cobbling together information from multiple disparate systems – often by hand – into meaningful reports is a time-consuming, error-prone process. By the time a report is finally assembled, it might be woefully out of date. And without the help of sophisticated analytics to calculate potential risk and prioritize efforts, you are left managing corporate compliance largely through a lens only able to focus on the past, not the future.

Without an integrated view of compliance-related activities, it’s nearly impossible to identify gaps and inconsistencies in how compliance is tracked and managed. That means a damaging risk can easily slip by undetected or unaddressed because you couldn’t gauge the full impact until it was too late.

40% of compliance teams

spend at least 4 hours per week creating and amending reports for the board.

The Pressure is Building on Corporate Compliance Teams

The current take-no-prisoners social, economic, and regulatory environment is turning up the pressure on compliance from multiple fronts:

Relentless scrutiny by stakeholders.

In today’s connected world, organizations have no room to hide from the judgement of boards, customers, investors, regulators, or the public at large.

Ever-changing rules and regulations.

The unabated torrent of regulatory change makes it harder than ever to simply keep up, let alone optimize the compliance function.

Exponential growth of third-party relationships.

Not only do you inherit the risks of your vendors and other third-party suppliers, you are at risk for any misdeed by their vendors, their vendors’ vendors’, and so on down the line.

Steep consequences for failure.

Monetary fines for noncompliance are at an all-time high – and the reputational hit can be at least as damaging.

The Value of Compliance Technology

Modern technology makes compliance less painful, less expensive, and less risky. It unites compliance processes and roles across the organization for seamless collaboration and intelligent insights that drive data-driven decisions. It offers huge gains in efficiency, while reducing both costs and the risk of noncompliance. With integrated technology, even small compliance teams can keep up with the constant pressure of both external and internal demands.

What can you do with up-to-date compliance software?

Get more done. Technology does more than simply ease the burden on the compliance team – though it certainly does do that. It automates workflows, assessments, control testing, and remediation assignments, drastically reducing the amount of time and effort needed from the compliance team. With technology, you can leverage a single assessment across multiple mandates. So instead of endlessly chasing down data, you can focus on investigating facts, understanding anomalies, and remediating issues.

Deal with endless change. A significant part of compliance management involves staying on top of an endless number of regulations that are in a constant state of flux. Integrated technology is designed not only to efficiently keep up with new regulations and laws but stay a step ahead of your compliance risk and the impact on the organization.

Know who did what and when. Having all compliance-related items in a single repository with robust tracking capabilities provides you with a clear audit trail documenting every modification.

Collaborate seamlessly. An integrated solution brings all corporate and legal policies, procedures, and requirements into one place that’s easily accessible to all stakeholders. It breaks down silos by establishing consistent processes and controls across the organization. By making it easier to communicate with the entire organization, technology also fosters a risk-aware culture and creates a sense of ownership where everyone has a part in reducing the organization’s chances of noncompliance.

See the big picture. Integrated technology allows you to connect initiatives and data to uncover real insights about how one part of the program affects another and the cumulative impact on the organization. With better insight into your program as whole, you can better identify, prioritize, and address issues before they escalate into full-fledged problems.

Answer tough questions. With streamlined processes, real-time data, and built-in analytics, integrated compliance technology makes it fast and easy to create meaningful reports that inspire data-driven decisions. Dashboards give you continuous insight into the effectiveness of your programs. And advanced analytics augment human intelligence by pulling out new and more detailed information from the data. Having this level of insight also allows compliance teams to offer strategic counsel and predictive insights to leadership.

56% of organizations

spend at least 4 hours per week tracking and analyzing regulatory developments.

Benchmarking Data – Free for the Asking

Which regulations are highly enforced? Which are lightly enforced? Which levy the most expensive fines for noncompliance? Complying with every single regulation in every single jurisdiction may be the ideal – but few companies have the resources to live up to that mark. Industry-specific benchmarking data can help prioritize your compliance efforts. It’s readily available – and free! – if you know where to look.

Financial services:

Healthcare:

Security:

All industries:

VERIS database

ISAC (Member ISACs have benchmarking data for specific industries.)

Integrating AI into Corporate Compliance

Artificial intelligence has the power to transform nearly every aspect of business – including compliance. Machine learning has long helped analyze data and predict outcomes. But the introduction of generative AI – like ChatGPT – takes that power to a new level.

For compliance, AI presents new opportunities to automate, augment, and accelerate work processes. It can expand your abilities and reach by reimagining how work gets done.

ChatGPT and other generative AI tools are built on large-language models trained on massive amounts of text scraped from the internet to learn the patterns of human language. The data supercharges its capabilities, allowing it to analyze data, find patterns, and devise solutions faster than any human could.

The potential impacts on compliance are wide. Already, AI is assisting with analyzing regulations and comparing them to a company’s policies and practices. Companies are asking how AI can make board reporting faster, easier, and better.

AI can extend the reach of the compliance team by making associated tasks easier and faster. AI can even reduce the steps needed in a workflow. With more automation, you have fewer manual interactions, and those actions combine into a stronger workflow.

Generative AI is best at generating content. With just a few prompts, ChatGPT can spit out a draft in a matter of seconds. That initial draft may not be flawless, but it can probably bring you about 50% – 70% of the way there. Then you can refine it with substance, tone, and voice to fit your organization.

Think of AI as an accelerator. It can simplify complex data, translate lengthy and technical information (like regulations) into plain English, and eliminate tedious manual work. However, you still must review the response, adjust it, and take it forward.

Clear compliance use cases for ChatGPT include:

- Policy drafts

- Control content

- Laws and regulations interpretation

- Potential controls

- Language translations

This list is just a start – the potential is almost endless. It’s all about understanding what you are trying to accomplish and where AI can provide a boost.

To be sure, generative AI is not without concerns. Everyone – from regulators to the inventors themselves – is trying to figure out the proper safeguards. Meantime, here are a few risks to watch out for:

Hallucinations – ChatGPT is programmed to provide a response, specifically the best next word in a sentence. In that process, it could make up the answer with no basis in fact. Always review and validate the response before you pass along information.

Bias – ChatGPT uses historical information to build new content. The problem is that what was acceptable in, for example, 1970, may not match today’s standards. And vice versa. Ensure the content generated by ChatGPT is relevant and appropriate for your question and for your organization’s policies and culture.

Data privacy and security – ChatGPT captures everything you type into the prompt and incorporates it into the model. Be cognizant of what information you are sharing outside of your organization. Protect yourself by defining proper use cases and your parameters for using them safely. ChatGPT also does not cite sources, making it difficult to verify the accuracy and reliability of the information provided.

What a High-Performing Compliance Process Looks Like

What differentiates a high-performing compliance process from the merely adequate? The unobstructed flow of information across all parts of the organization. Stand-out compliance programs give all authorized stakeholders access to the same high-quality, real-time data. They can share information and easily collaborate on actions – without ever leaving the platform.

High-performing compliance teams also don’t waste time emailing spreadsheets back and forth or chasing down responses – they have technology to do that. Instead, they spend their time focusing on why, not what, investigating issues, understanding irregularities, finding solutions, and creating value. And looking ahead, an efficient, well-constructed compliance process lays a strong foundation to successfully withstand whatever challenges may come your way.

What Makes a Compliance Program Best-in-Class?

- Compliance and ethics are deeply embedded into the corporate culture.

- A chief compliance/ethics officer is a visible and valued part of senior leadership.

- Technology enables continuous monitoring and advanced analytics to make forward-looking, data-driven decisions every step of the way.

Evaluating Compliance Software: A Checklist

Keeping up with constantly changing regulations and policies takes a software solution that’s flexible, scalable, and integrated. The right technology will add efficiency, prove effectiveness, and elevate the value of the compliance function to the organization. As you evaluate possible solutions, consider asking:

Selecting a corporate compliance software solution can be overwhelming. Do you look at a point solution – or a comprehensive solution that makes it easy to share data and collaborate across the organization? Either way, an RFP is critical to finding the right partners.

Download this template or a list of the most critical compliance-related questions to guide your purchase process. The questions are presented in a downloadable spreadsheet, which can be easily modified to suit your needs.

Imagine the Power of Integration.

Breaking down silos between compliance, third-party risk management, and internal audit makes for more agile and coordinated response to risks that often overlap. And that’s powerful. Now imagine if you could follow that through to the insured side of the house.

Technology that’s truly integrated not only shows you the impact of your compliance, third-party risk management, and internal audit risks – it shows you if those risks could lead to any claims, for instance, and the expected cost to resolve those claims. You’ll finally be able to understand the full impact of any risk on the organization.

Imagine what you could do with that kind of power.

Learn how to conquer the new world of risk with integrated risk management here.

Where to Begin Your Compliance Transformation

The goal is to move corporate compliance from an after-the-fact, transaction-based function to one that’s forward-looking and data-driven with the power to influence strategic decisions at the highest level. Here are 10 steps to get you started:

-

Determine what you want your final process to look like.

-

Define your biggest challenges.

-

Take a complete inventory of all regulations and policies with which you must comply.

-

Define the control processes that will ensure compliance and determine the metrics you’ll use to measure your progress.

-

Map out where information currently resides and who has ownership.

-

Centralize all regulatory requirements and internal policies, and integrate with third-party risk management, internal audit, and other risk management functions.

-

Use analytics to identify weaknesses and gaps in regulatory and policy initiatives.

-

Identify what changes are necessary to achieve your objectives.

-

Calculate a compliance score and risk score – and layer in both to determine priorities.

-

Monitor the effectiveness of your controls, and make any necessary improvements

How to Build a Business Case for Compliance Software

Boards and top executives may recognize that technology will provide better oversight and enhance compliance overall – but still fail to allocate budget. The challenge is defining and measuring value – cost, flexibility, efficiency, effectiveness – in a way that’s meaningful enough to sway those holding the purse strings.

Modern compliance software standardizes processes, streamlines data collection, and enforces security. Automating routine tasks allows the compliance team to shift from collecting data to higher-value work like investigating and remediating issues. Built-in analytics and centralized data provide fresh, data-driven insights, identify interdependencies that otherwise would have gone unnoticed, and give you an early look at risk indicators that can be used to drive strategic vision.

You can get more done, deliver better results – and you can prove it.

Real-time reporting extracts the story within your data for better, faster decisions. And dashboards allow continuous monitoring of key indicators and metrics. In short, you have hard data on the current status of your compliance program, where your weaknesses are, and what needs to be done. Always.

A well-run corporate compliance program does more than make sure you have a defensible position if a regulator comes knocking on your door. By breaking down silos, centralizing data, and facilitating collaboration, modern, integrated compliance technology embeds a compliance mindset into the fabric of the organization and pushes all employees to consider ethics and compliance when making everyday decisions.

And it turns out that organizations with strong compliance programs have better top- and bottom-line performance, as well as less danger of reputational and other risks.

While technology cannot replace an experienced corporate compliance team, it does redefine its role. The right technology transforms compliance into a trusted advisor with a voice in how business is conducted – a value that goes well beyond simply checking boxes.