Intelligent Risk

Powered by AI

Riskonnect’s Intelligent Risk redefines how risk is managed in an AI-driven world.

Intelligent Risk integrates AI into all risk domains, creating an interconnected intelligence layer that helps you anticipate, respond to, and act on risk with insights no one else can see.

Guide

Turn complexity into clarity

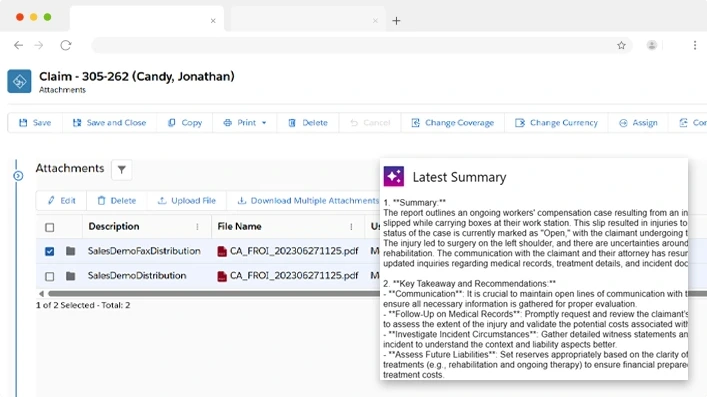

Leveraging large language models – LLMs – Riskonnect’s Intelligent Risk guides you to the right actions by filtering out noise, surfacing emerging risks, and providing clear, concise summaries of documents.

- Save time and improve accuracy with automatic classification of claims details, auto-populated ACORD insurance forms, and clear summaries of adjuster notes, medical records, and claim files.

- Act early on changing conditions with AI-generated risk and control suggestions.

- Speed decision-making by getting clear answers faster.

Predict

See risks before they strike

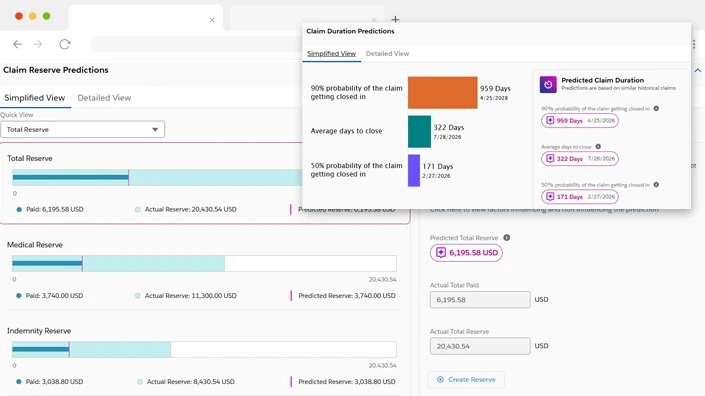

Powered by machine-learning, Intelligent Risk predicts risk outcomes, uncovers patterns, and identifies probabilities before risk strikes.

- Lower costs with AI-boosted predictions for claims duration, litigation probability, and reserve auto-scoring, and automated intake agents.

- Improve strategic planning with Monte Carlo simulations that model likelihood and impact of risks in different scenarios.

- Identify gaps and strengthen resilience with AI-boosted threat intelligence stress testing.

Assist

Focus on impact, not tasks

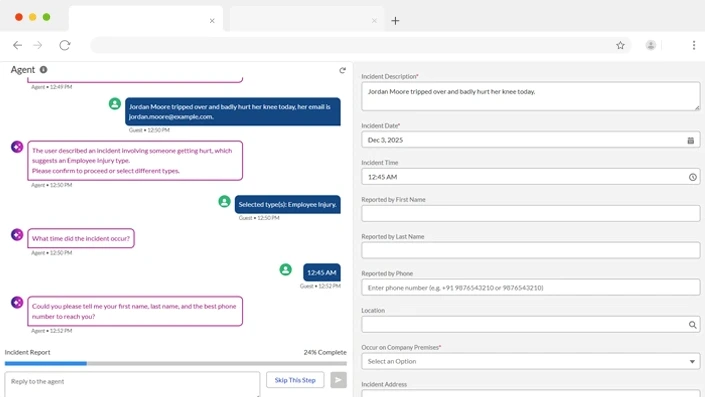

Agentic AI works behind the scenes to assist decision-making by automating complex tasks and processes.

- Resolve claims faster by minimizing staff time needed for intake and making analytics understandable to anyone.

- Virtually eliminate missed obligations by mapping regulatory changes to policies and controls with agentic AI audit coordination.

- Cut incident response time by as much as half by reducing repeat test failures and unplanned downtime.

AI Power:

The Core of Riskonnect

Intelligent Risk integrates AI across the entire Riskonnect suite, from insurable risk to GRC and Business Continuity & Resilience. The framework connects risk data, organizational context, and machine intelligence into a single, adaptive system that learns from every interaction.

Built-in, not bolted on. AI capabilities are embedded directly into the platform, not layered on disconnected tools, which brings contextual knowledge across incidents, claims, audits, third-party risk, compliance obligations, and more.

Instant intelligence. AI capabilities extract insight from any type of data, summarize the information, and recommend actions.

Human enhancement, not human replacement. AI capabilities are designed to augment human expertise and prioritize explainability, control, and transparency.

Now that we’re entering full on into the world of artificial intelligence, we wanted a company that we felt was growing and building and really listening and hearing where we wanted to go. Once we have the guidance from Riskonnect, we know we’ll be able to tap into them, but we also will be able to take off and do things on our own.”

Caryn Douma, University of Pennsylvania Health System

What Makes Riskonnect’s

Intelligent Risk Different

- Unified ArchitectureRiskonnect weaves AI across all solutions, not siloed tools

- Enterprise-Grade GovernanceRiskonnect is built to meet regulatory, ethical, and audit requirements

- ControlRiskonnect gives you control with opt-in activation, full transparency, and data sovereignty

- Innovation At ScaleRiskonnect’s AI Lab is dedicated to accelerating feature delivery and model evolution

- Strategic PartnershipsRiskonnect offers deep collaboration with Microsoft Fabric, Power BI, and OpenAI to help you stay ahead of market trends

Get Started with These Helpful Resources

Intelligence to Claims Processing

of Risk Report

Industry Recognition for Riskonnect