At some point, many organizations realize that they need to manage risk in a more deliberate and organized way. So, what is RMIS – and could it make a difference to your results?

A Risk Management Information System (RMIS software) is a platform for collecting, managing, analyzing, and reporting risk, claims, and safety information.

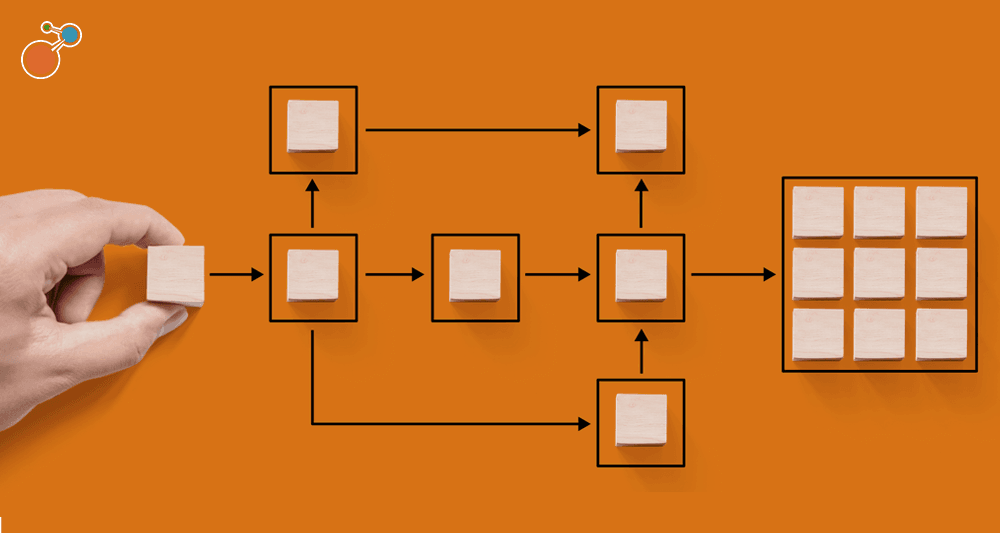

A RMIS brings all of your insured risk data together into one place to give you a clear view of your risks, the relationships, and the impact on the organization. A RMIS saves time and improves accuracy by automating tasks and streamlining workflows. It reduces risk exposure, the stress on risk management – and the total cost of risk.

With a RMIS, risk teams can stop managing spreadsheets, documents, and emails and start managing risk at a strategic level. Here are four things to know about today’s RMIS technology:

1. A RMIS is not just for claims.

RMIS software does make managing claims easy, fast, and accurate. Users have one centralized source to track claim status, validate data, and view payment history. You can even compare outcomes of similar claims and analyze the cause of a loss.

But managing claims is just the beginning. A RMIS seamlessly integrates all risk, claims, and safety information into a single, comprehensive, up-to-the-minute workflow continuum. It gives you the visibility to effectively manage risks across the organization. It also can reveal gaps or duplications in coverage and appropriately allocate premiums.

The real power of a RMIS, though, is when the system is leveraged to identify and respond to emerging risks and trends that might otherwise go unnoticed. The centralized view, accessible platform, and enhanced reporting of a RMIS also facilitate communication and collaboration across the organization.

2. A RMIS is easy to use.

No IT expertise is needed for today’s RMIS. The current generation of RMIS software is easy to use with consumer-like features that are intuitive, integrated, and reliable.

Dashboards combine visually appealing graphics with powerful analytics to deliver the information you need when you need it. Reports are available at the touch of a button – no reformatting or cutting and pasting required. And a cloud-based system is accessible by anyone, at any time, from anywhere.

As with any new technology, however, upfront training is necessary to get the most value from your RMIS investment. Yes, there is a learning curve. But the value gained by expanding your risk understanding far outweighs the cost of sticking with your current routine.

3. A RMIS is lightyears ahead of spreadsheets.

Comparing a RMIS to a spreadsheet is like comparing your latest smart phone to a flip phone from the ‘90s. The similarities between the two ends when you want to do anything more than the basics.

Spreadsheets can be an effective tool for managing risk at companies with limited numbers of locations, employees, assets, and carriers. But this tool has a hard time keeping up with the amount of data needed to effectively manage a growing portfolio of risk. You might end up making mission-critical decisions based on outdated or error-riddled data.

Spreadsheets are particularly vulnerable to:

- Data errors. Spreadsheets rely mostly on manual labor to collect, verify, format, consolidate, and input information. Not only is this process extraordinarily time consuming, every keystroke or cut-and-paste action increases the risk of human error.

- Security threats. Restrictions on who has access are notoriously difficult to impose on spreadsheets. As a result, information can easily fall into the wrong hands. If the spreadsheet includes sensitive information, the company could be in serious trouble.

- Disaster-recovery problems. What happens if a laptop is lost or stolen? Your data might disappear along with the laptop since spreadsheets aren’t always automatically backed up. If true catastrophe strikes, you could lose everything.

A RMIS minimizes data-entry mistakes by guiding users through a streamlined collection process. Changes and updates can be made instantly, in one place, at one time. Everything is documented so you always know who made what change and why.

Access to a RMIS is available on any device from anywhere – as long as the user is authorized. And a RMIS stores and protects your data in a secure, cloud-based system that can be verified by independent third parties.

4. A RMIS returns far more than your investment.

Buying a RMIS is a significant investment – but it ultimately pays for itself by:

- Increasing productivity. How much time are you currently spending to collect, format, and consolidate data – then turn this information into meaningful, actionable reports? RMIS software does all this automatically, which frees up your time to actually analyze the data and respond appropriately.

- Replacing other technology. No matter what system you’re using, you’re already spending money on some kind of technology to manage risk, safety, and claims data. The total cost of maintaining these separate systems and spreadsheets might surprise you. This is all money that can be redirected toward a RMIS.

- Improving accuracy. The centralized view from a RMIS helps you better understand the relationships between critical risks and the cumulative impact on the organization. This information can help you make smarter, faster decisions to mitigate losses – and ultimately lower premiums.

The fact is no risk management technology is free. If the upfront cost of a RMIS seems steep, imagine trying to justify a loss caused by an undetected spreadsheet error. The true cost of any solution has to be measured in terms of the total operational cost to the organization over the long term.

Find everything you ever wanted to know about RMIS in our Definitive Guide. And if you’re ready to take the next step, download our RPF Template for RMIS for a list of the most critical RMIS-related questions to include in a request for proposal.