Riskonnect Blog

Welcome to Riskonnect, the place where risk and compliance professionals can find expert advice, practical tips, and useful information to do their jobs easier, faster, and more effectively.

IT Risk Assessments: A Step-by-Step Approach

When IT is at risk, it’s a priority for everyone in your business – not just the tech team. IT risk assessments help organizations identify and manage threats targeting digital infrastructure and data. [...]

How to Take the Right Level of Risk to Achieve Your Strategic Objectives

All organizations must take a certain degree of calculated risk to grow and mature their business. But how can senior leaders decide which risks are worth taking? To make the right decisions they need [...]

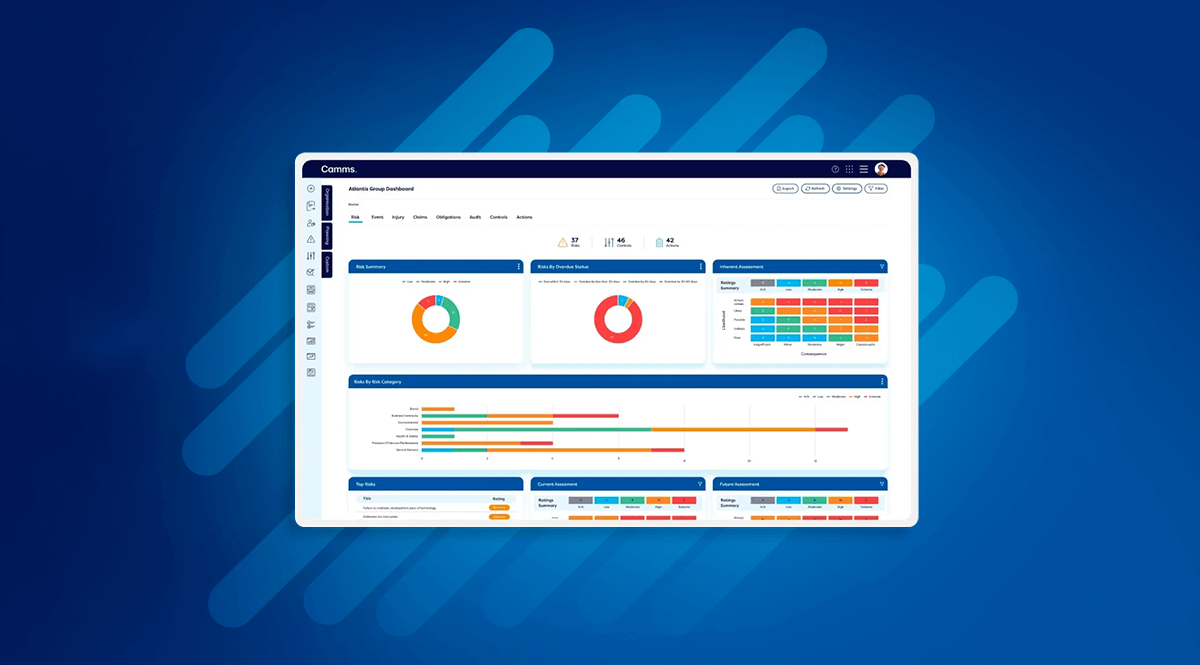

15 Key Features to Look for in Your Next GRC Platform

Effective risk management is crucial for safeguarding your organization’s assets and reputation and for ensuring long-term success. As threats and vulnerabilities become increasingly complex and operations become heavily reliant on systems and technology, [...]

How to Make a Business Case for GRC

A governance, risk, and compliance program can help an organization address uncertainty, avoid surprises, and achieve business objectives. Every organization has some form of GRC, even if it is not called that. After [...]

How to Lessen the Pain of Ransomware Attacks

Ransomware attacks have skyrocketed. Nearly three-quarters of businesses worldwide have been hit with an attack. And the cost of these attacks is exploding. Consider Change Healthcare, which expects to rack up as much [...]

A New Era: Embracing the Role of Digital Risk & Resilience

By Michael Rasmussen, The GRC Pundit & Analyst, GRC 20/20 Research In the rapidly evolving landscape of governance, risk management, and compliance (GRC), information security is undergoing a significant transformation. This evolution reflects [...]

AI in Risk Management: Dangers, Opportunities, and How Best to Use It

Using AI in risk management may be slightly scary because there are so many unknowns. The possible efficiencies and insights are certainly tantalizing – but are the risks significant enough to be a [...]

Are Investment Banks Prioritizing Market and Credit Risk at the Expense of Operational Risk?

Is the intense focus on market and credit risk in investment bank risk management leading to the neglect of significant operational risks? With many modern financial firms heavily reliant on digital systems, mobile apps, [...]

What Is a Key Risk Indicator and Why Is It Important?

Key risk indicators – or KRIs – are canary-in-the-coalmine metrics that can alert you to changing conditions. They are your early indication of an increase or decrease in risk exposure in various areas [...]

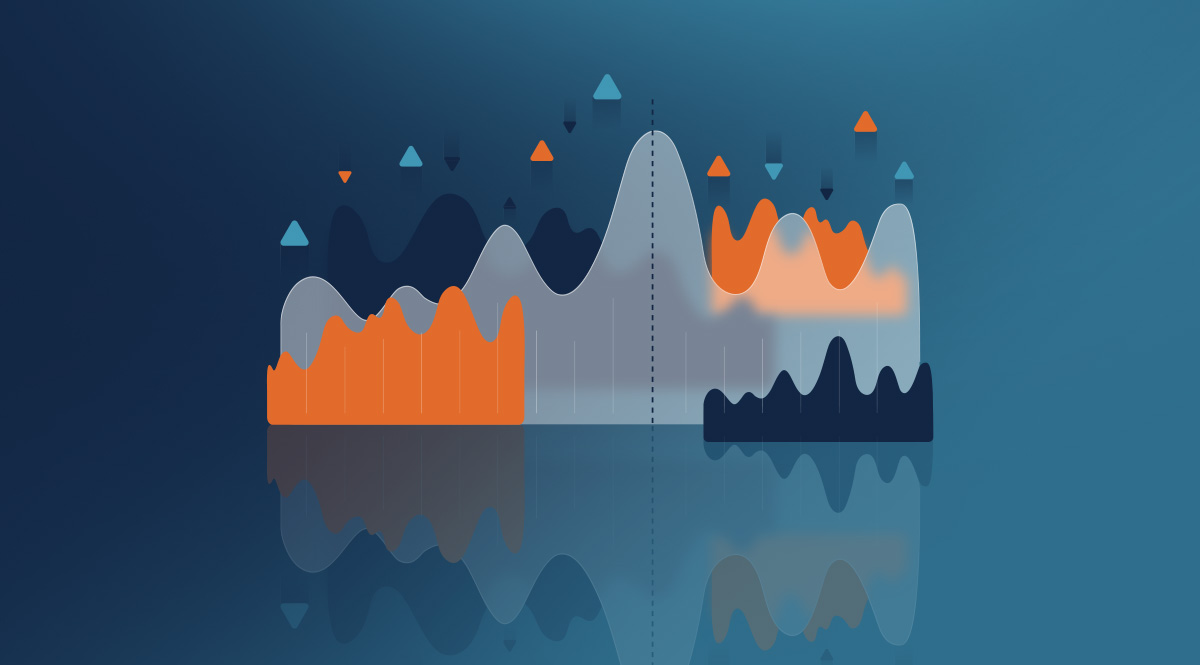

Monte Carlo Analysis: A Powerful Tool for Risk Management

Monte Carlo risk analysis is a powerful technique used in risk management to model and visualize uncertainty and risk exposure based on different scenarios and outcomes. These simulations allow professionals to model uncertainties [...]