By Marina Mats and Deepak Varshney

With a return to “normal” still stubbornly distant, COVID-19 remains the prominent force shaping claims trends. In many places, restrictions were cautiously eased – just to be restarted when cases surged. And businesses were left trying to take it all in stride.

How does that uneven impact translate into incident experience? Here’s a look at current trends by line of coverage and by industry, based on the U.S. property and casualty incident data of more than 400 organizations across 20 industries.

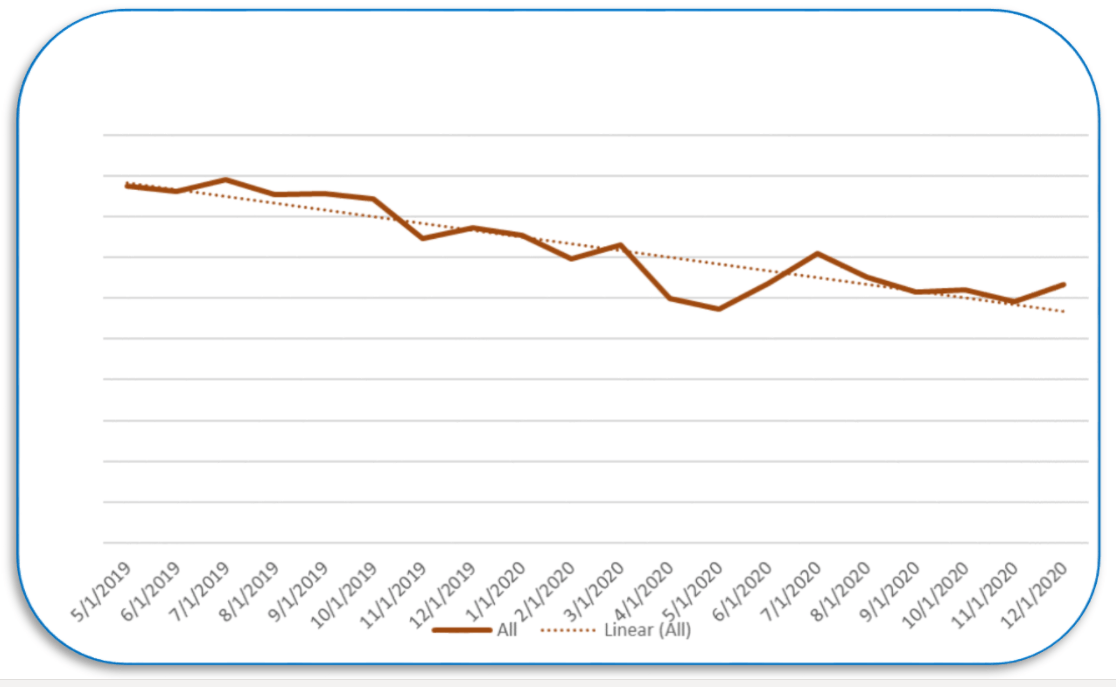

Overall Incident Volume

The overall number of incidents is down 18% compared with one year ago. April had the lowest number of incidents – which is not surprising given that most of the country was under a tight lockdown. Since then, the number of incidents has been rising steadily, increasing by 5% by December 2020. The good news is that trends continue to show improvements month over month across the board.

Overall Claim Volume

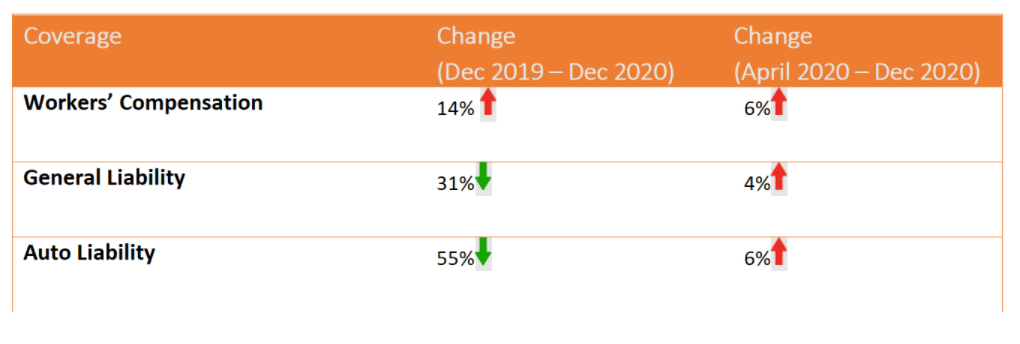

By Line of Coverage

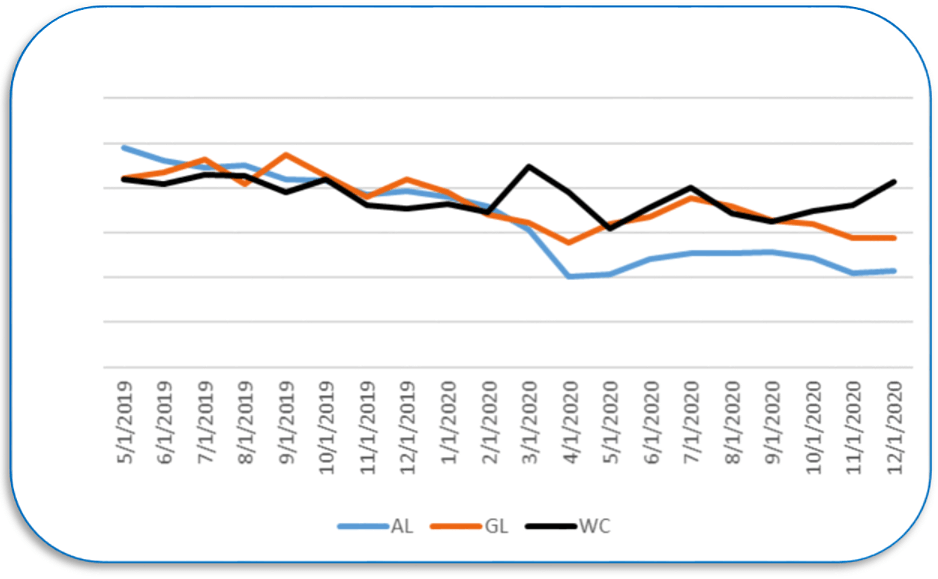

General Liability. As a sign of the lingering effects of the pandemic, the overall number of GL incidents is down by nearly a third compared to December 2019. However, the number of claims has ticked up slowly, increasing 4% since April.

Auto. Similarly, the number of AL incidents dropped 55% compared to December 2019. However, the number of incidents is up 6% since April.

Workers’ Compensation. The volume of WC incidents jumped 6% since April – and 14% YOY. Interestingly, the WC volume fluctuated widely over those months, perhaps as a reflection of rolling lockdowns.

Claims Trend Watch by Line of Coverage

2019-2020 Incident Volume by Line of Coverage

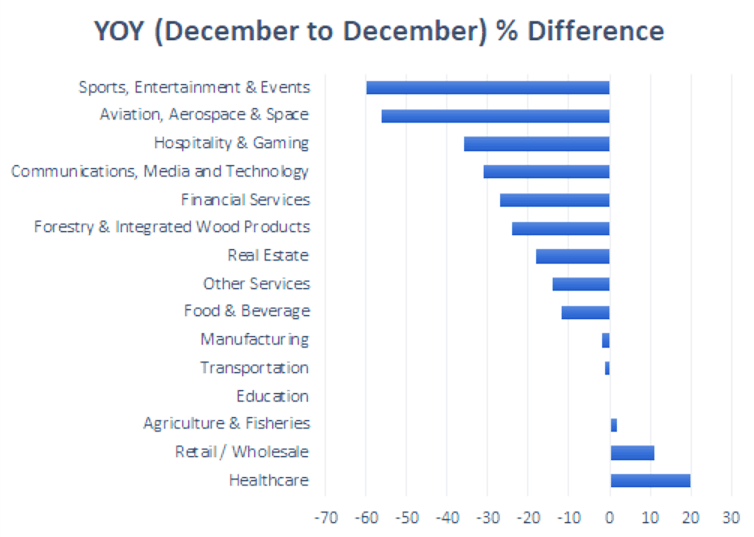

By Industry

Sports, Entertainment and Events. Even though professional sporting events resumed, fans remain largely absent from the stands, leading to a drop in incidents of 60% compared with December 2019 – the biggest reduction of all industries. Since the peak of the lockdown in April, however, the number of incidents is up 91%.

Travel, Hospitality, Gaming, Food & Beverage. Holiday travel contributed to an increase in incidents in hospitality and gaming, as well as in aviation, up 55% and 41%, respectively. Compared to a year ago, however, volume is down by 36% in hospitality and gaming and by 56% in aviation – which is not surprising since these industries are operating at a much lower capacity than before.

Education. Many students and educators returned to schools and colleges with at least partial in-person attendance, which caused the number of incidents to spike by 77% since April when most students were fully remote. This brings the volume of incidents back to a level almost identical to a year ago.

Healthcare. Incidents in the healthcare industry are up 20% since December 2019 and 5% since April. The increase could be attributed to spikes in COVID-19 cases – or possibly pent-up demand for previously postponed procedures.

Claim Trends Watch by Industry

For a look at past trends, check out Claims Trend Watch: Q2 2020 and Claims Trend Watch: Q3 2020.

For more on managing claims effectively, download our e-book, Claim Success: How to Achieve Excellence in Claims Management