Riskonnect Blog

Welcome to Riskonnect, the place where risk and compliance professionals can find expert advice, practical tips, and useful information to do their jobs easier, faster, and more effectively.

IT Risk Assessments: A Step-by-Step Approach

When IT is at risk, it’s a priority for everyone in your business – not just the tech team. IT risk assessments help organizations identify and manage threats targeting digital infrastructure and data. [...]

Monte Carlo Analysis: A Powerful Tool for Risk Management

Monte Carlo risk analysis is a powerful technique used in risk management to model and visualize uncertainty and risk exposure based on different scenarios and outcomes. These simulations allow professionals to model uncertainties [...]

Effective Project Management in the Pharmaceutical and Life Sciences Sector

Pharma is booming, and the race to bring new drugs into the market has never been closer. This has underscored the pivotal role of effective project management in the pharmaceutical industry, as drug [...]

Financial Services Compliance: Move from Obligation to Opportunity

Financial services compliance is a daunting proposition for banks, insurance companies, investment firms, and FinTech firms worldwide. The rules and regulations are complex and ever-expanding – and compliance is often viewed as a [...]

Comprehensive Guide to Risk and Compliance in the Legal Sector

The legal industry is governed by complex regulations and high standards of ethical conduct, necessitating stringent legal risk and compliance measures. With these requirements comes a multitude of risks that law firms must manage to [...]

U.S. Army Successfully Combats Project Risks with Riskonnect’s Active Risk Manager

The United States Army oversees dozens of complex projects critical to national defense and has relied on Riskonnect for nearly a decade to manage risk and keep those projects successfully advancing forward. DOWNLOAD THE [...]

Managing Compliance in the Pharmaceutical and Life Sciences Sector

For years now, the pharmaceutical and life sciences industry has had to contend with a less than stellar reputation mainly due to unethical business practices and high drug prices. The pharmaceutical industry is [...]

5 Project Management Risks and What You Can Do About Them

5 Project Management Risks and What You Can Do About Them Every project has its risks. With a small project of short duration, modest budget, and few stakeholders, those risks may be relatively [...]

Managing Risk: Lessons for the Education Sector

Schools, colleges and universities have had a lot to deal with over the past two tumultuous years. And with new risks emerging at a regular pace, heads of educational institutions no doubt have a [...]

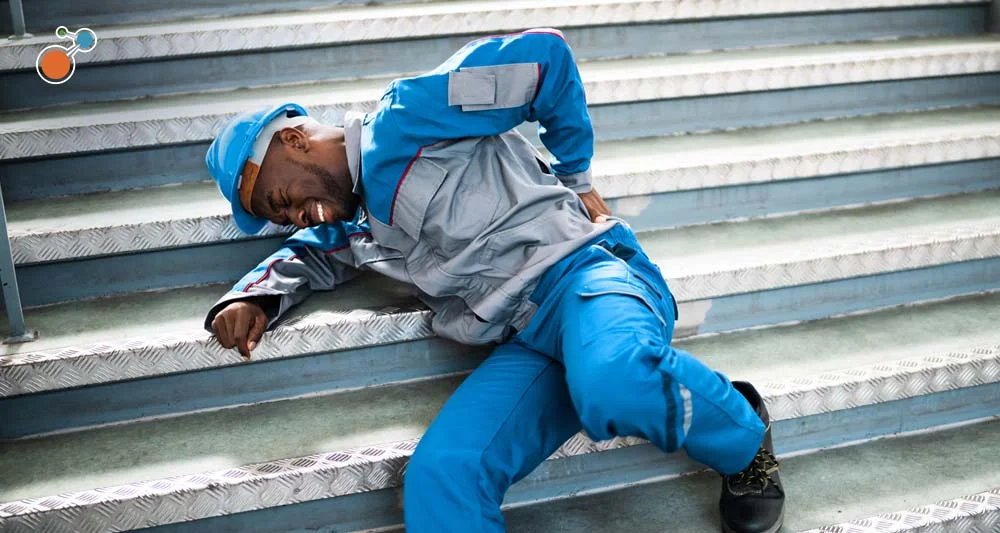

Workers’ Compensation Predictive Modeling: 7 Models That Make a Difference

Today’s increasingly sophisticated workers’ compensation predictive modeling can accurately forecast which injured workers are most likely to struggle with returning to work, which claims could turn into something severe, and which claims need [...]