Riskonnect for the Insurer/TPA Industry

Riskonnect software integrates risk data, analytics, and insight to give you a leg up on the competition.

Insurers and TPAs are under tremendous pressure to manage evolving risk in less time with fewer resources. Ever-changing regulatory demands, multiple systems, and disparate data formats can slow the process down to a crawl. And any delay means higher costs.

Turn Risk into a Competitive Advantage

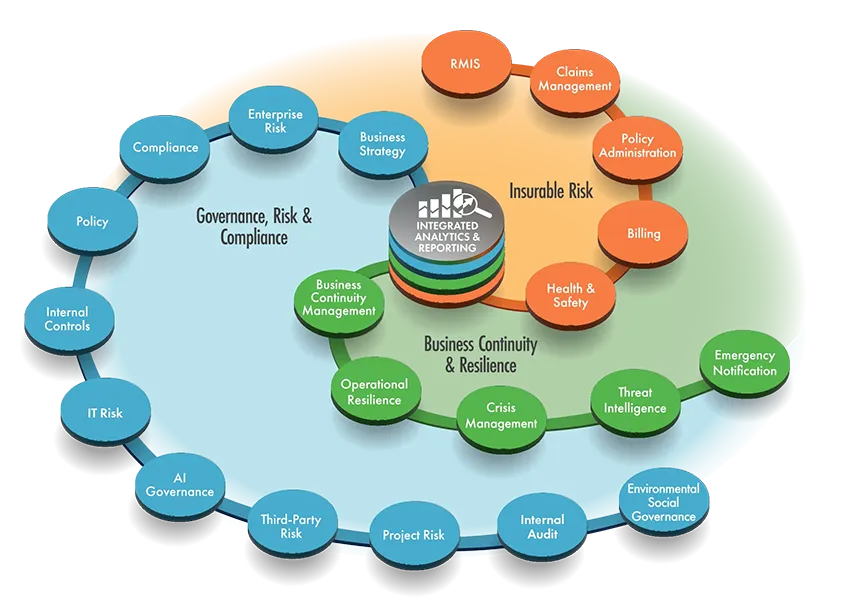

Riskonnect can help you stay ahead of the curve instead of scrambling to adapt after the fact. With real-time data, streamlined workflows, and a 360-degree view of risk, Riskonnect gives you everything you need to proactively manage all forms of risk across the enterprise.

My relationship with Riskonnect in one word is partnership. We do all of these things together. There’s a degree of understanding on both sides that helps us achieve the final outcome.

Find answers – fast.

Everything you need to identify, manage, and mitigate risk is all in one, easily accessible place.

Get more done.

Routine processes are streamlined and automated so you can spend your time where it matters most.

Make better decisions.

Riskonnect gives you the intelligence to identify and respond to evolving risk, stay compliant across the board, and make informed decisions that will add value to the business.