Every day brings new evidence that the world of risk is changing and changing fast. New risks seem to lurk around every corner – and virtually every risk is gaining in velocity and ferocity, with no relief in sight.

Traditional risk management techniques view risks one by one, department by department – which worked just fine at one time. But the world has changed.

The pandemic revealed how quickly the traditional way of managing risk and compliance fails when tested by fast-moving, interconnected threats. But even when the pandemic wanes, don’t expect a return to the “good old days.” Plenty of other forces were already at work reshaping the risk landscape:

- Accelerating digitization of risk management. The internet of things, third parties, blockchain – every new point of access adds vulnerability and increases risk exponentially.

- Growing importance of risk management in corporate strategy. Risk management is increasingly seen not just as a tactical function, but as a valuable part of corporate strategy – a trend fast-tracked by the coronavirus pandemic. Indeed, risk management is now a C-suite priority at forward-thinking organizations.

- Rising pace and scope of regulatory compliance. Virtually every organization in every industry is facing an ever-growing and ever-changing number of regulations with which they must comply. The pandemic magnified just how challenging it is to keep up with constantly evolving requirements if you’re operating without well-defined controls.

- Evolving sophistication of analytics. Better analytics are delivering new levels of insight for data-driven decisions – and if you don’t have that, you’ll be at a significant competitive disadvantage.

- Increasing demands from the outside. The influence of social media, constant threats of cyberattacks, and demands for greater transparency are amping up the pressure on executives and boards to make wise decisions about risk at an accelerated pace with little room for error.

The New World of Risk

Dealing with this changing world of risk requires new skills, new tactics, new methods, and new leadership. Stakeholders across the organization need to be able to freely exchange data and ideas to proactively address accelerated and amplified risks. And all that intelligence needs to be available in real time to top decision-makers, who must continually make hard strategic choices to drive organizational success.

Risk is risk, regardless of where it comes from. Anything that could harm your organization, its competitive position, reputation, or growth needs to be anticipated, assessed, addressed, and acted upon. You must be able to see every risk, how each one connects to other risks, and how the impact rolls up to the enterprise level.

In short, risk management can no longer be segregated into insurable and noninsurable buckets to be independently managed by disconnected teams using separate point solutions. Managing risk in this new world takes an integrated approach. You simply cannot make sense of it all standing in a silo.

See It All – Right Where You Are

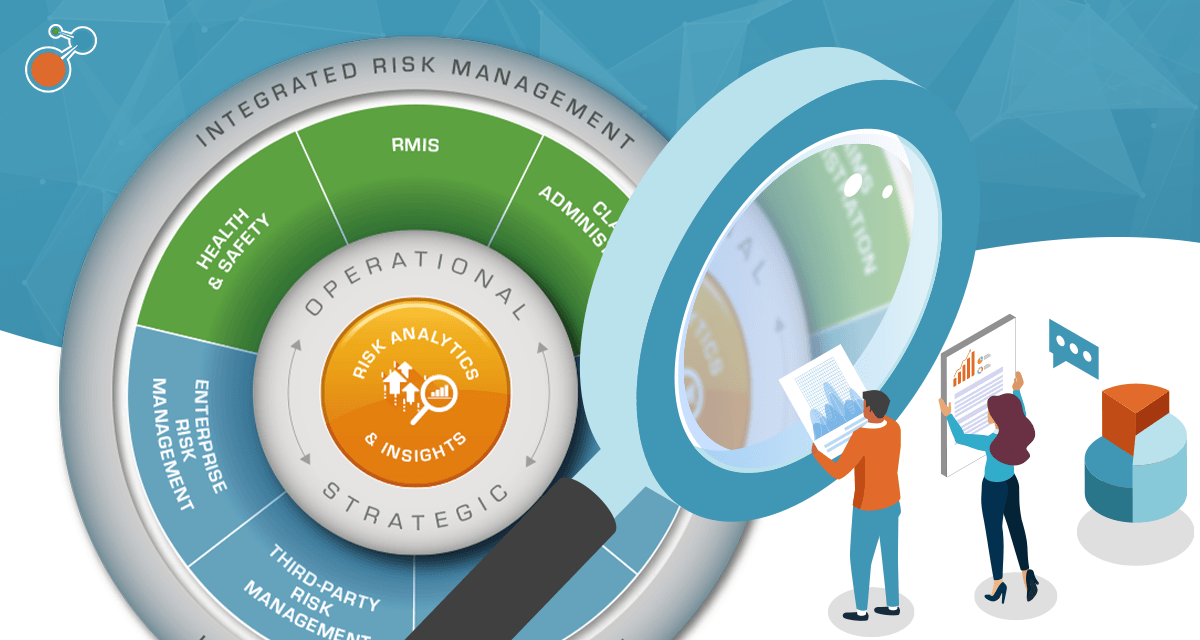

Integrated risk management brings together all forms of corporate risk, merging the insurance-based (RMIS) side with the governance, risk, and compliance (GRC) side for a comprehensive, end-to-end view of risk across the organization. It breaks down silos, automates manual processes, and improves response time.

Data from claims, safety, enterprise risk, third-party risk, compliance, internal audit, and more is all in one place where it can be analyzed, correlated, shared, and visualized in a human-friendly way for rational decision-making. You get a clear view of how a risk event would impact every part of the organization – giving you the vision to make smart, timely decisions to minimize risk and maximize opportunity.

With IRM, risk is no longer something only to be feared, avoided, or minimized. Risk becomes a tool to create strategic value and elevate performance.

The fact is you don’t know what you don’t know – and what you don’t know can most definitely hurt you. After all, if you can’t see what’s coming, how can you possibly get in front of it?

For more on Integrated Risk Management, download our e-book, Conquering the New World of Risk with Integrated Risk Management.