Insurable Risk Solutions

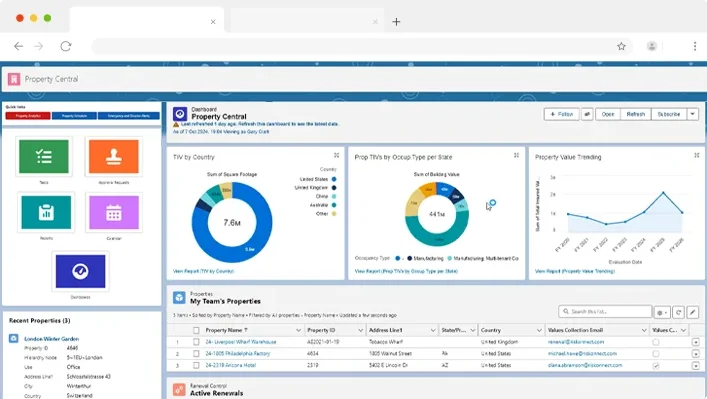

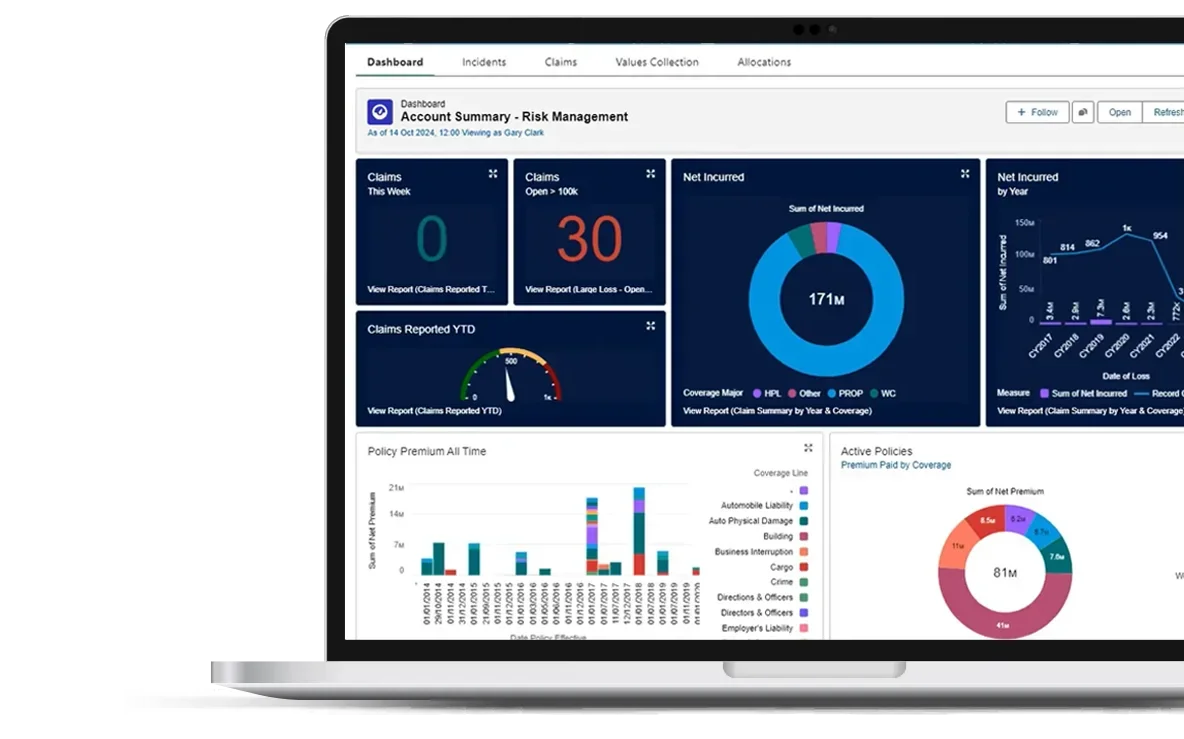

Riskonnect’s risk and claims management solutions consolidate your insured risk data to give you a clear view of your risks, the relationships, and the impact on the organization.

Spend your time where it matters most. Streamline processes, automate workflows, and eliminate duplication of effort to free up valuable resources and get more done.

Uncover insights you can trust. Consolidate data from all stakeholders and systems – including carriers, TPAs, vendors, brokers, and employees – into one, easily accessible view.

Optimize your insurance spend. Turn complicated data into actionable insights to improve pricing and coverage decisions.

Risk and Claims Management Software

Product Highlights

Discount Tire

I wasn’t looking for a platform to do just claims management, but I really wasn’t sure what I was looking for until we got deeper into Riskonnect and became aware of what we could do. Riskonnect has done a really nice job of helping us aggregate [claims] data and turn it into actionable insights that we can use. And our safety program has excelled at leveraging that information.”

Chris Henrichsen, Risk and Litigation Officer, Discount Tire

IHG® Hotels & Resorts

Riskonnect is helping us in terms of achieving financial accuracy for payments for insurers, which is great. We have full visibility of what’s going on in terms of claims management from start to end.”

Marcela Siera, Insurance Systems Manager, IHG® Hotels & Resorts

Randstad

Riskonnect has allowed us to embark on actions we’ve never had clarity on before. If no action is coming out of the data, what’s the point.”

Trey Braden, Director, Risk Management, Randstad

Riskonnect Stands Out in

Redhand RMIS Report

Reduce

TCOR

Feeling the pressure to reduce total cost of risk – in less time with fewer resources? Riskonnect’s risk and claims management software seamlessly integrates people, systems, and data to help you make more informed decisions about risk to keep costs in check.

- Consolidate real-time risk data from multiple internal and external sources to identify trends, emerging risks, and opportunities.

- Understand the relationships between critical risks and the impact on the organization.

- Seamlessly integrate data from carriers, TPAs, third-party vendors, and internal departments into one source of truth.

- Gain strategic insights to optimize your insurance program.

- Identify cost-savings opportunities that previously may have gone unnoticed.

Say Goodbye

to Frustration

How much time is wasted tracking down information with endless back-and-forth emails or adding it to yet another spreadsheet? Riskonnect’s risk and claims management software streamlines and automates routine processes so you can spend your time delivering human-worthy insights from data you trust.

- Save time and money by streamlining and automating processes.

- Capture data consistently and thoroughly with standard templates, intuitive forms, and auto-filled fields.

- Minimize human error by guiding users through the data-collection process.

- Eliminate duplicate data entry by automatically uploading information.

- Send alerts, reminders, and progress reports automatically.

- Communicate seamlessly using SMS text, WhatsApp, and other channels.

Get Started with These Helpful Resources

Industry Recognition for Riskonnect