How much risk is in your blind spot?

There are business risks that are nearly invisible to you now because the insights you need are hiding in silos across every department.

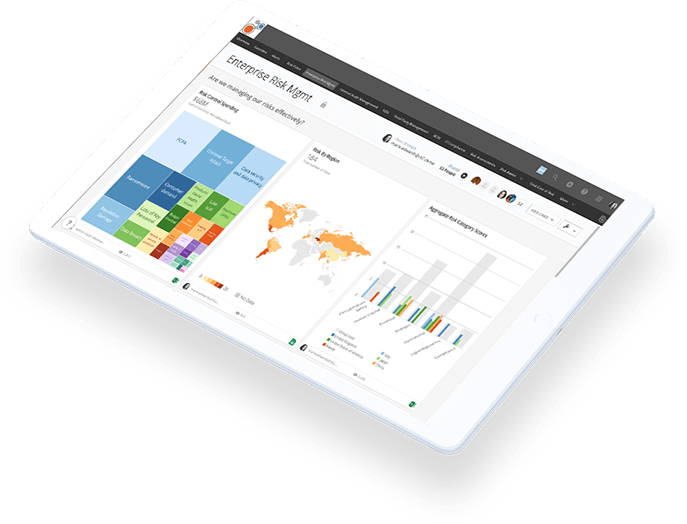

Riskonnect is the only risk platform that unifies data across silos for both insurable and noninsurable risk, giving you a unique, 360-degree view of risks to your competitive position, growth and reputation.

Without a truly integrated view of your company’s

risks, you don’t know what you don’t know.

“Because of Riskonnect, we were able to move forward with a new piece of business.”

– Stanley Steemer

- Get the intelligence you need when you need it, how you need it.

- Turn risk into a strategic advantage.

- Make decisions about risk with confidence.

Faster…must go faster!

Riskonnect’s solution is more than just a suite of products. Our platform breaks new ground by providing a comprehensive, end-to-end view of risk across the organization.

Executives from the 950+ global Riskonnect customers can view dashboards that merge risk data with other factors like share price and reputational events to achieve a unique view of their risk profile.

Riskonnect Reduces Costs—Both in Time and Resources

Forrester Consulting recently completed a Total Economic Impact™ study of a Riskonnect customer to quantify the potential ROI of implementing an integrated risk management solution.

Here’s a quick look at what they found:

- $442,975 in total savings, including deprecation of old systems

- 10% improvement in claims processing efficiency

- 40+ hours per month in time savings

“Riskonnect … will inevitably drive better decisions for everybody.”

– Covenant Transportation Group

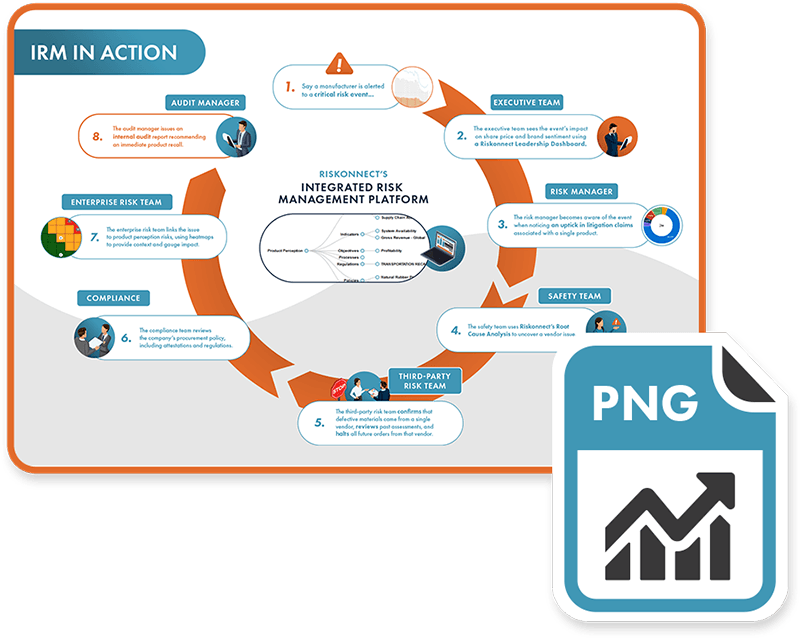

Understand Incidents by Tracing Them Across Silos

When a risk event happens, multiple risk teams may be involved in addressing it. An issue that surfaces as an odd grouping of insurance claims may have its true roots in compliance, third-party management or elsewhere.

Do your current systems give you the insights you need to understand how a given incident will impact every part of your business?

This infographic illustrates how a particular risk event can touch every risk-related department, and how crucial it is that they all have access to a unified risk platform.

See what Riskonnect can do for you.