INSURANCE MANAGEMENT

Software that makes it easy to manage every aspect of your insurance program

How long would it take you to answer

a basic question about your insurance coverage?

Answering even simple questions about coverage can be difficult and time-consuming if the information is buried in paper files or stored with a broker. And the more brokers, carriers, claims, and policies you have, the harder it is to keep track of insurance coverage on all exposures or verify coverage when an event happens.

Better Analysis, Deeper Insight

Riskonnect’s Insurance Management software provides a quick and easy way to manage your policies from all carriers and brokers to give you better analysis, deeper insight – and ultimately reduce your Total Cost of Risk.

POLICY MANAGEMENT

PROGRAM MANAGEMENT

EROSION ANALYTICS

Risk Management Information Systems:

The Buyer’s Guide

Whether you are purchasing a RMIS for the first time, replacing a homegrown system, or upgrading outdated technology, our Buyer’s Guide offers valuable insight to help you make a wise choice.

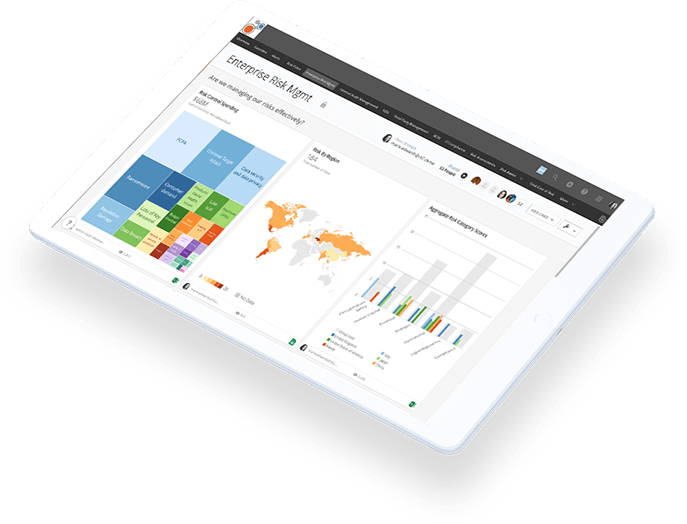

How’s Your View?

Find out how

Riskonnect can transform

the way you view risk.