Daniel Halter, Risk All-Stars

Daniel Halter

Global Head of Risk Management & HSSEQ

CEVA Logistics

What is your educational background?

I started my career with an education in private insurance (Federal diploma in private insurance), followed by additional training in insurance law and marketing. I continued with a degree in economics, risk management, and communication. After this I attended various training, including the ARMA (AIG Risk Management Academy), and have taught at seminars.

Did you know you wanted to go into the risk profession? If not, what was your journey to get here?

I was looking to do my apprenticeship in a bank, but by occasion I started in private insurance, which has been very fulfilling. I like to understand all matters of challenges and risks and address them systematically e.g., high claims experience and how to address the underlying factors to reduce risk and achieve lower costs.

How long have you been working in the risk profession?

I started in insurance underwriting in 1993 at the age of 16 and moved into risk management on customer side in 2007. Before joining CEVA in 2015 I worked some months in a risk consulting start-up.

What do you love most about what you do?

Anticipating risk and focusing on prevention to protect the balance sheet. Insurance requires the same underlying information, which reflects all facets of a company. It fascinates me to use various kinds of risk information to proactively address risks; enhance the insurance, risk, and crisis management landscape; and engage and inspire colleagues to create a sustainable, cost-effective way to mitigate risk and create true opportunities that are consistent with the company’s vision.

Has managing risk changed over the course of your career? If so, how?

I started by managing the global insurance programs. We soon grew to understand that how essential it is to be proactive in reducing risk. Early on, we combined risk financing with risk mitigation activities, such as HSE or security, and we also built up comprehensive crisis and BCP management. We also try to use our partners like brokers and insurers for their knowledge of data, know-how, and expertise in financing our insurance programs. For a long time, the insurance market was soft, which has recently changed dramatically. If you are not proactive in managing risks, your risk-financing costs will be very high. Good, reliable, and comprehensive data is very important. For instance, we try to understand health data to get the best treatment at the best pricing, as well to design effective prevention programs.

What advice would you give to someone who is about to start their career in the risk profession?

Be curious, try to get to the bottom of information, and think out of the box.

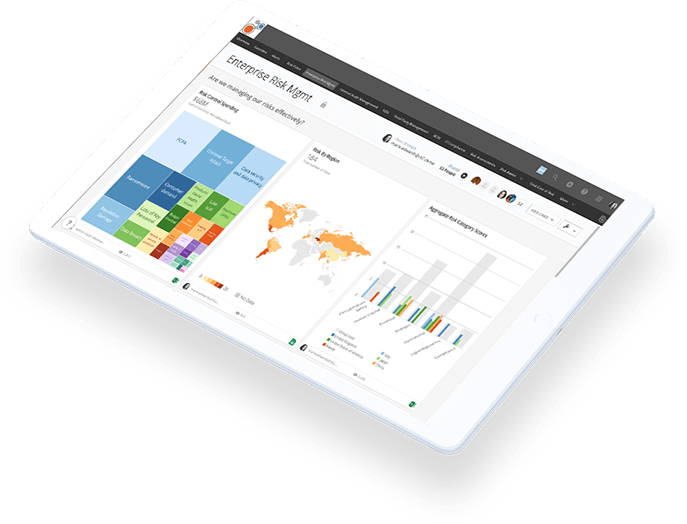

How’s Your View?

Find out how

Riskonnect can transform

the way you view risk.