Why Incident Management Apps Are a Must-Have

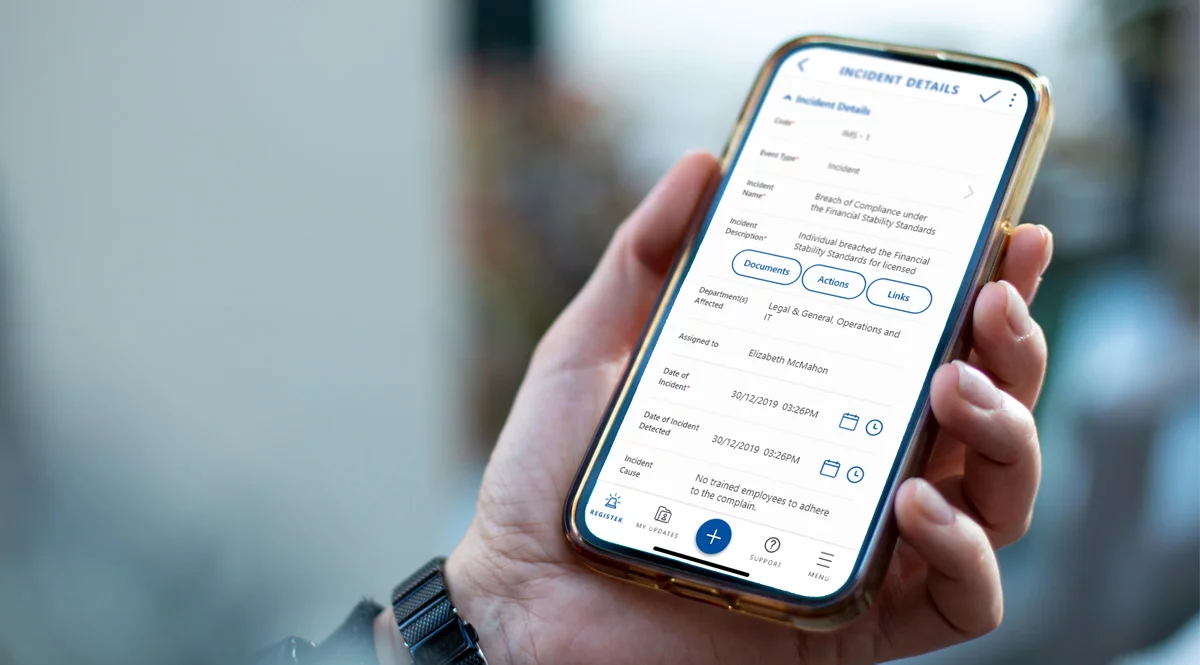

Organizations must be equipped to resolve incidents efficiently to maintain operations and protect staff and customers. Whether it’s a safety incident, IT failure, compliance breach, or operational disruption, organizations need a seamless way to capture, [...]