Industry Leading

Riskonnect’s risk management software solution is recognised by top analysts as an industry leader.

Intuitive

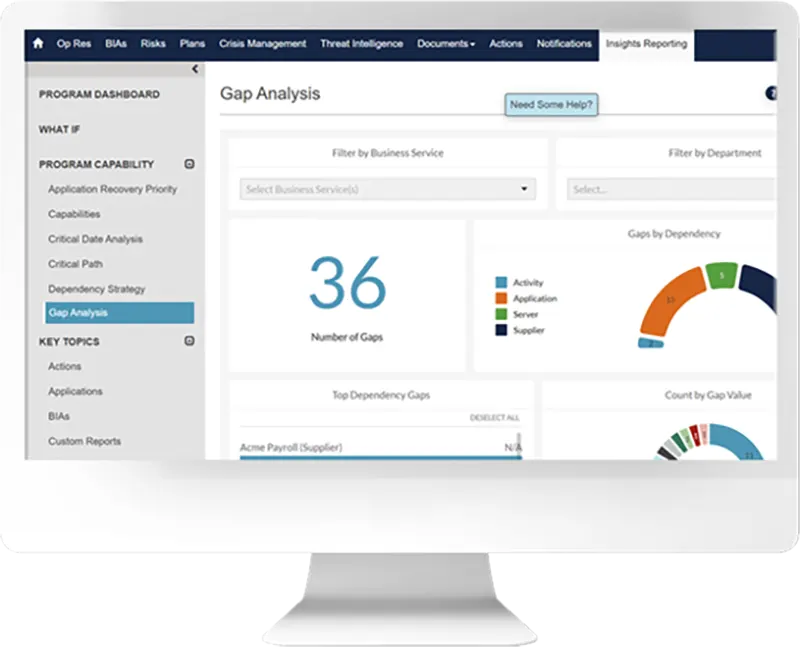

Riskonnect’s risk management solution offers a modern, intuitive interface that is easy to navigate even for occasional users.

Integrated

Riskonnect’s risk management SaaS Solutions brings all risk-related data into one source of truth accessible to all stakeholders.

How can risk management platforms support informed decision-making?

Build customised risk registers.

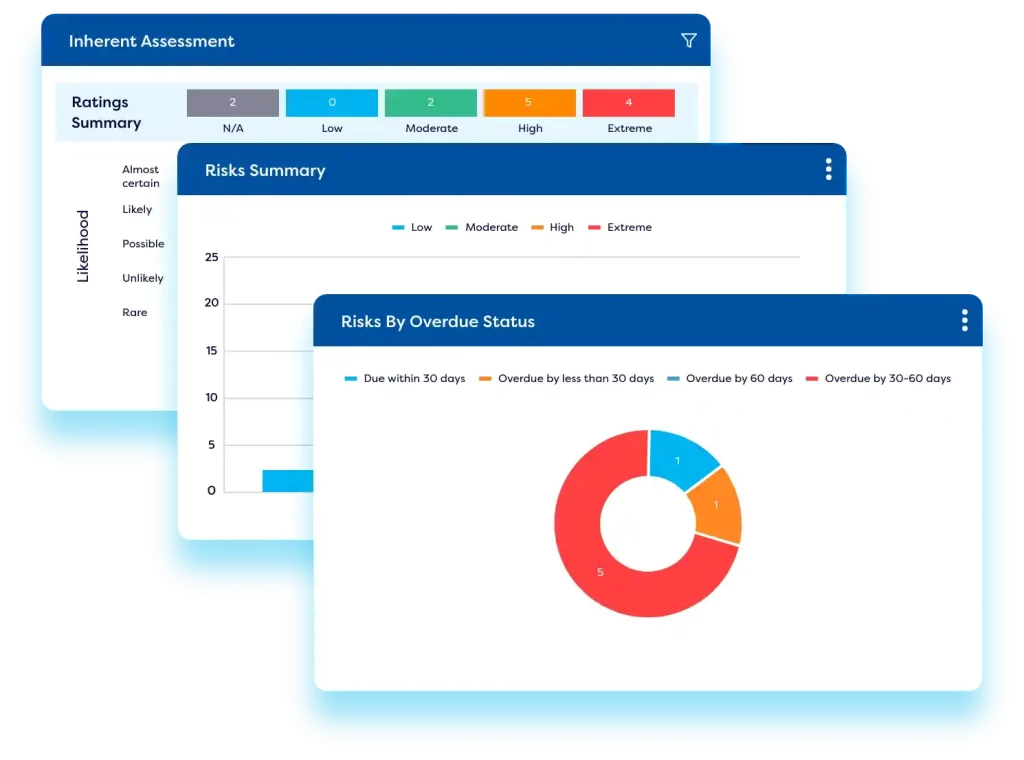

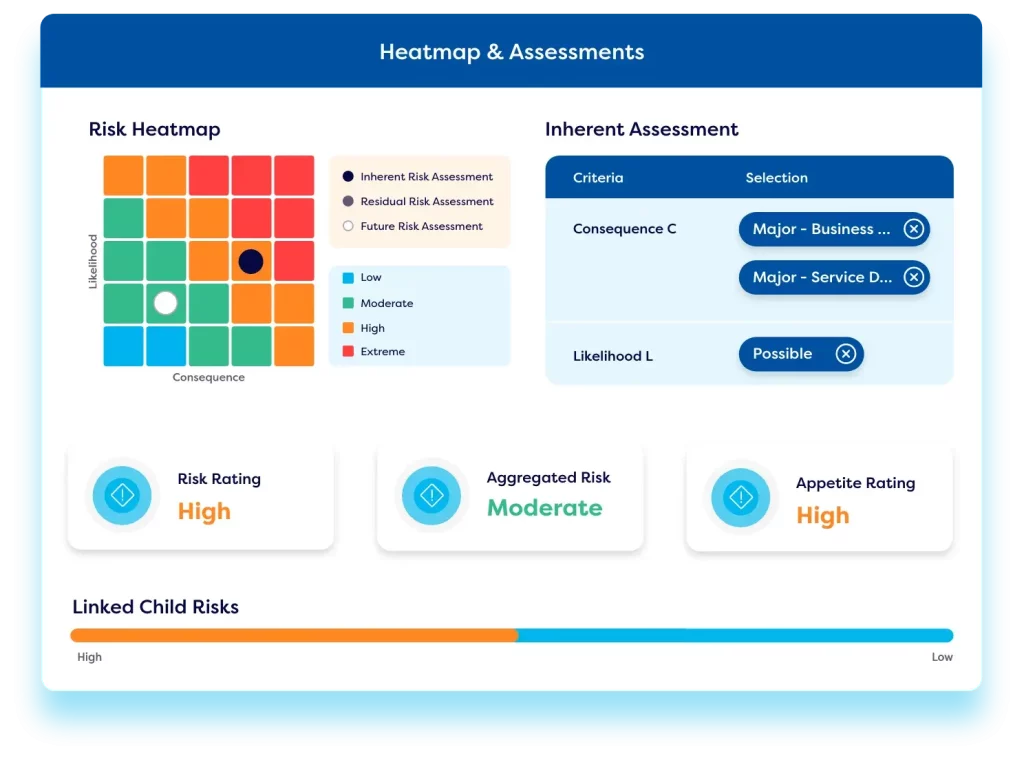

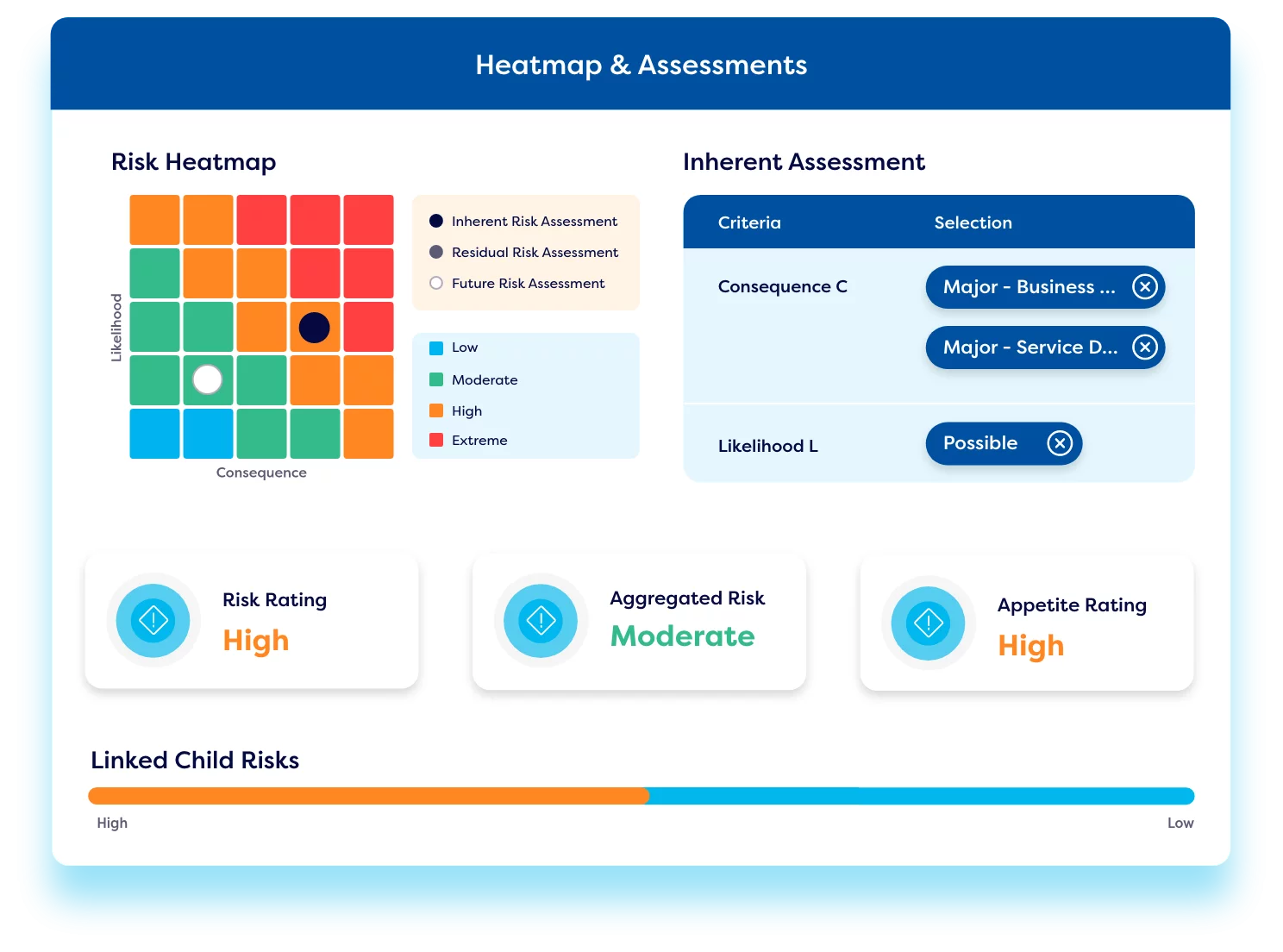

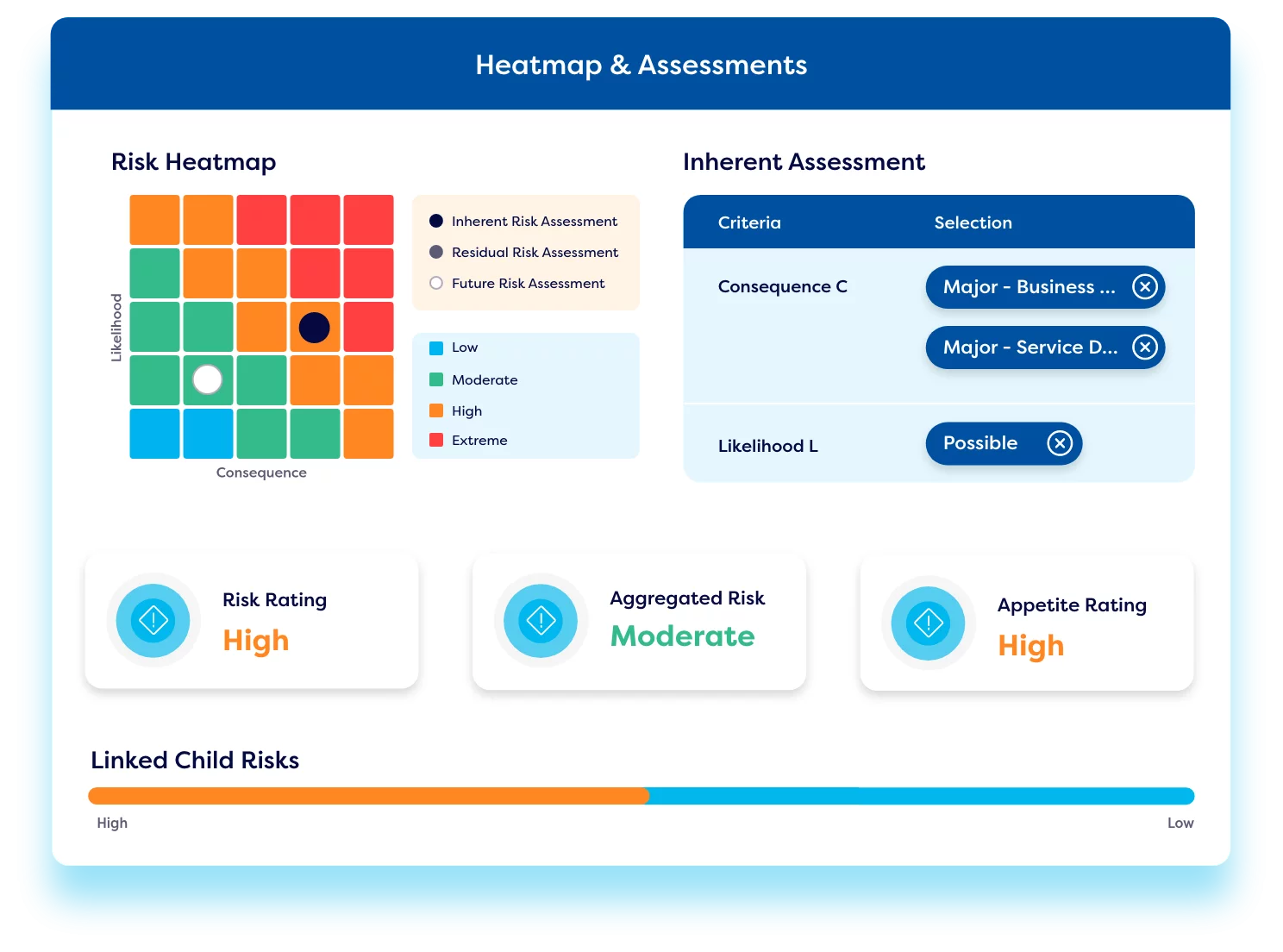

Business risk management software helps you create risk registers that use best-practice frameworks and templates to document threats in key areas like operational risk, cyber risk, strategic risk, project risk, and compliance risk. Within each risk register, you can categorise risks by type and severity, establish risk owners, and track approvals and escalations. You can also incorporate key risk indicators in the analysis.

Apply risk appetite and risk tolerance levels.

A risk management platform allows you to incorporate your established risk appetite and risk tolerance levels into the way risk is managed on a daily basis. Alerts can be set to automatically send notifications if levels are in danger of being exceeded.

Establish robust controls.

A risk management platform maps controls to risks, aligning practices with the requirements of COSO, ISO 31000, SOX, and other regulations. It simplifies control management by leveraging a single control across multiple risks and offers insight into potential risk exposure.

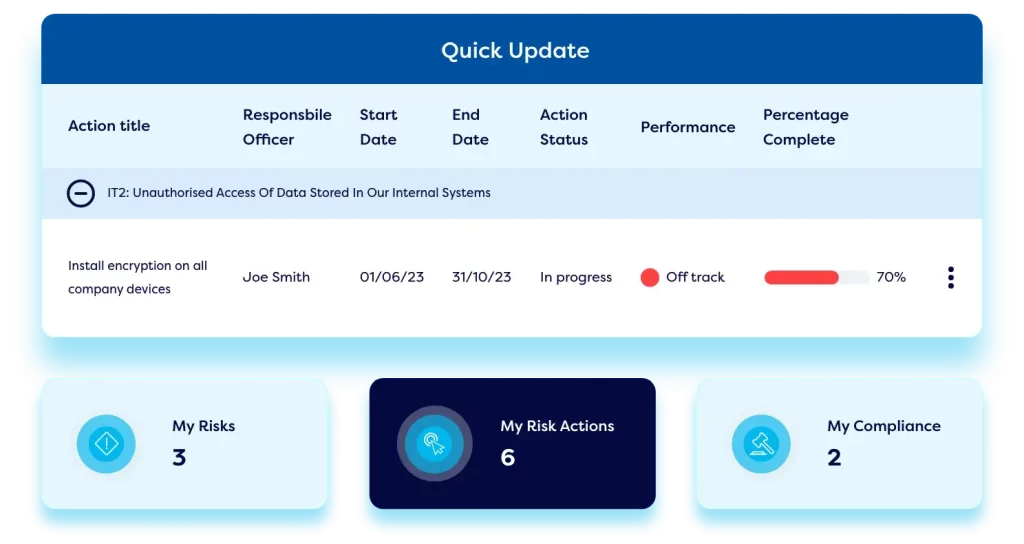

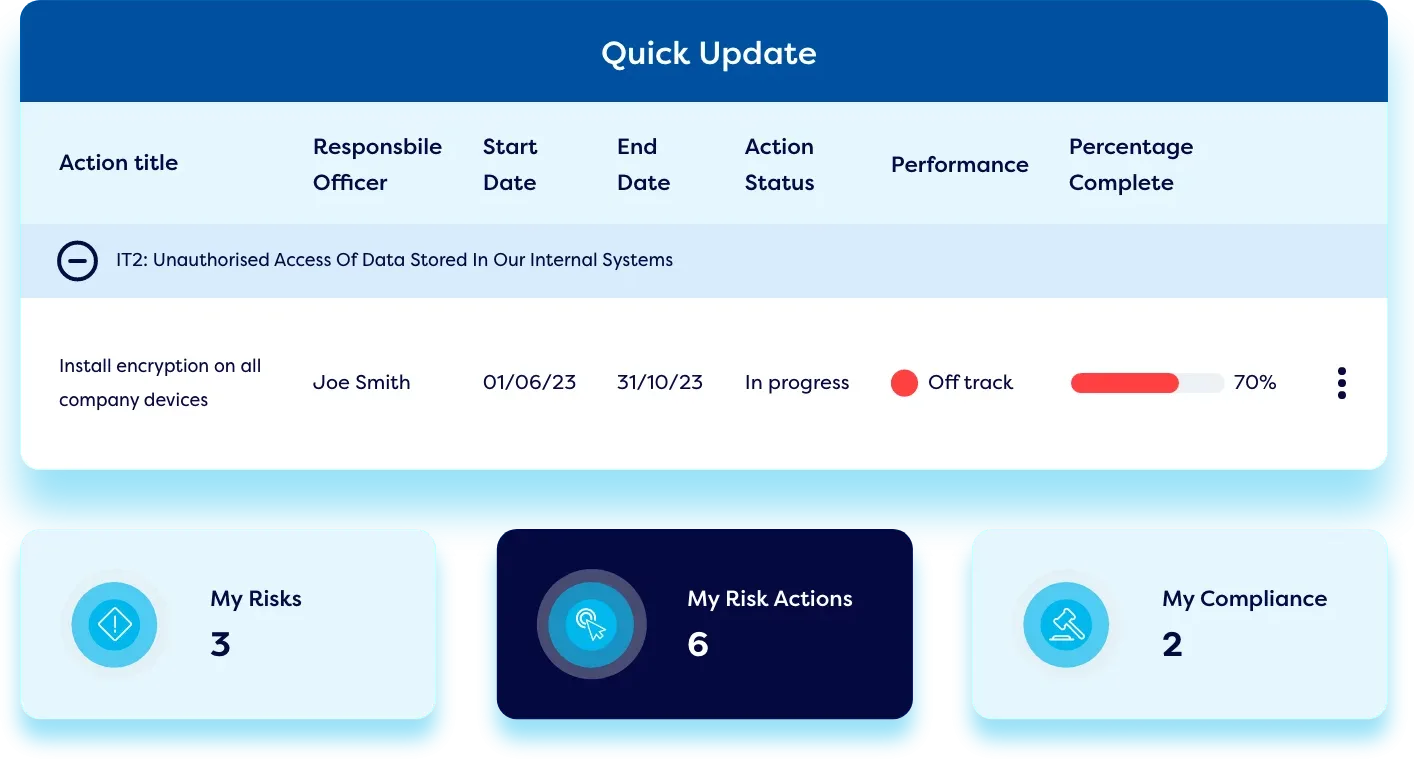

Create risk treatment plans.

A risk management platform provides a framework for automating workflows to assess, manage, and mitigate risks. Alerts can automatically be sent to risk owners and other stakeholders to keep everyone up to date and working together.

Understand your risk status.

Good risk analysis software provides a comprehensive view of risks across your enterprise. It offers easily customizable charts and graphs to help stakeholders instantly visualise complex data in a way most meaningful to each.

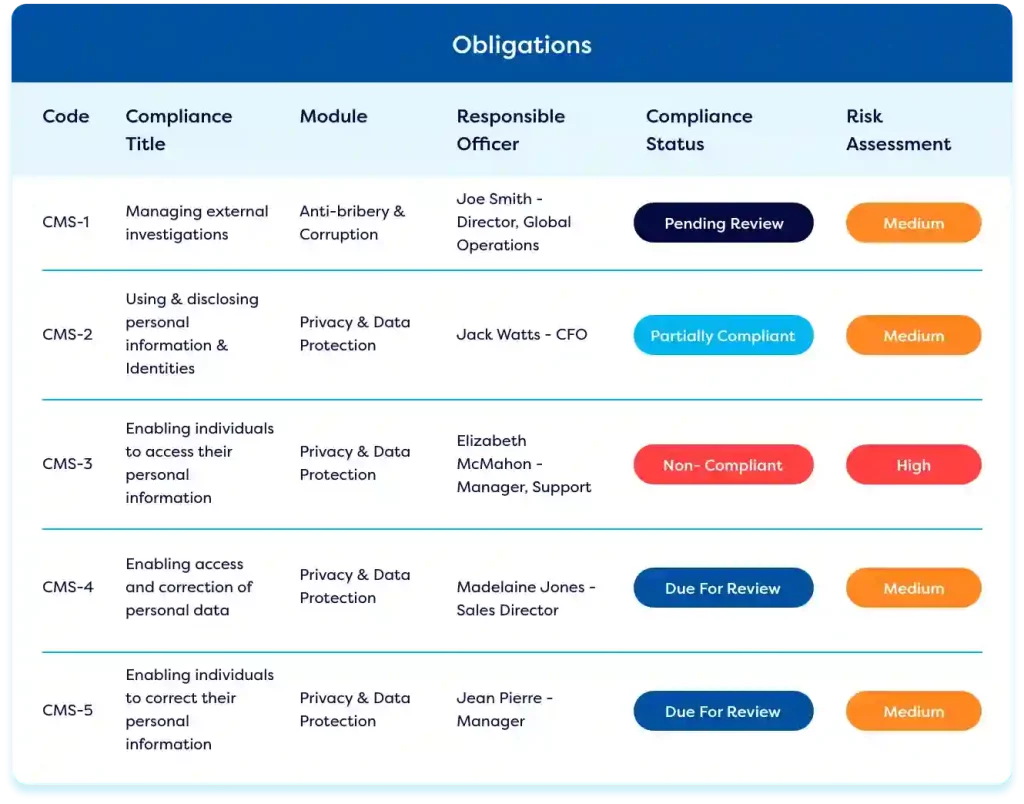

Maintain compliance.

A risk management platform helps you manage regulatory issues to reduce risk. It brings corporate and legal policies, procedures, and requirements together into one place to make sure nothing important is missed. It also helps you stay abreast of changing regulations and what you need to do to comply.

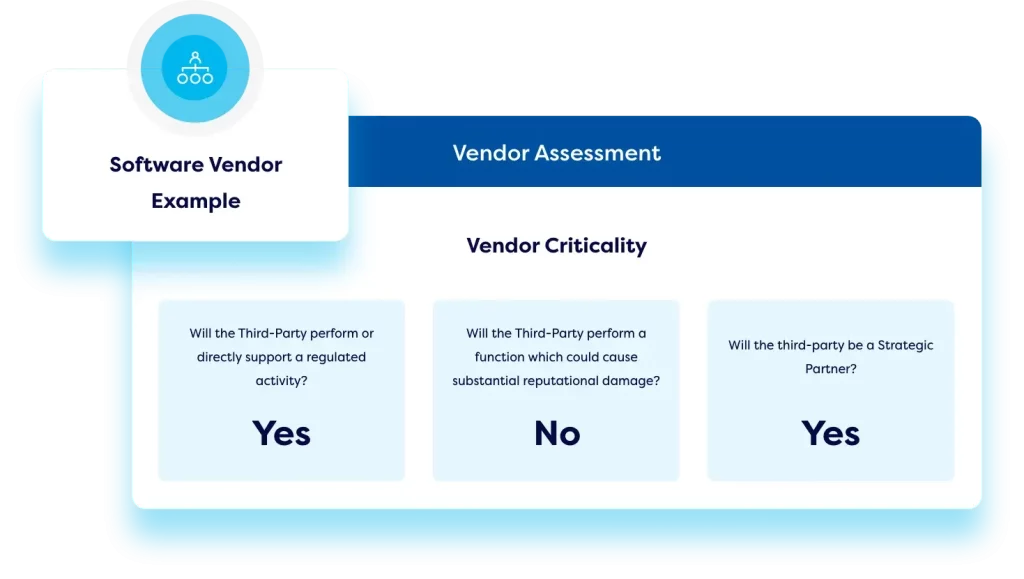

Manage third-party suppliers.

A risk management platform helps you keep track of your suppliers, understand their risks, and monitor compliance with your requirements. It automates vendor risk assessments to save time and improve reliability, while quickly onboarding new vendors. It also provides audit-ready documentation of your third parties.

Track and analyse incidents.

Good risk monitoring software helps you track and manage incidents with easy-to-use forms and automated workflows that track the incident through resolution. Critical details – including documents and images – can be attached directly in the file. And automatic alerts can notify the right stakeholders when an incident has occurred.

Audit effectiveness.

A risk management platform helps you systematically evaluate the effectiveness of your governance practices. It tracks every step of the audit process in one place, so you can quickly identify and address any gaps in controls. It also adds efficiency and consistency by automating workflows, standardising assessments, and seamlessly integrating data from multiple sources.

Link risk management with business strategy.

Solid risk management analytics software helps you develop, manage, and execute your strategy, measure ongoing performance, and communicate the status with the C-suite and board. It helps you visualise your end-to-end strategic plan and break down complex actions into smaller tasks with clear accountability. It empowers you to take calculated risks when it makes sense in terms of your broader goals.

What disciplines can be included in a risk management platform?

How can Riskonnect help?

Riskonnect is a highly configurable platform that can be tailored to your needs with:

Easy configurability

Intuitive interface

Mobile accessibility

Translation to multiple languages

Secure technology

Fast implementation

API integrations

Expandable platform

More Resources Related to Risk Management Platforms

Governance, Risk, and Compliance: The Definitive Guide

This ebook explains GRC and the value of an integrated approach for making smart, fast decisions.

RFP Template for GRC Software

This easily modifiable template will help you ask the right questions of vendors under consideration.

Complete Guide to Buying Risk Management Software

his ebook demystifies the software buying process with step-by-step navigation through the entire journey to help you identify the best fit for your organisation.

Find out more about Riskonnect’s risk management platform.

Learn more.